The mother of encryption says: "We need to reduce 'parental-style management'"

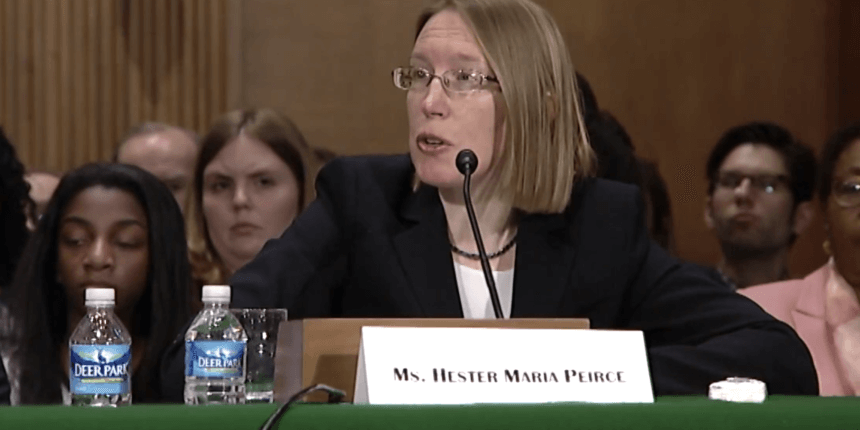

SEC Commissioner Hester Peirce, who has always been known for her openness to the crypto space, is hailed as the "Crypto Mom" by the crypto community. In a recent interview, she expressed concerns that overly protective regulations could undermine the U.S.' position in the cryptocurrency market and acknowledged that regulatory agencies' slow response to emerging technologies could hinder the country's development in the blockchain sector.

Table of Contents

During the "Digital Asset Compliance and Market Integrity Summit" hosted by law firm Hogan Lovells, former Nasdaq vice chairman interviewed Peirce, discussing whether the process of implementing new regulations "significantly diminishes the competitiveness of the United States."

Commissioner Peirce acknowledged this, recognizing the slow progress of the SEC in addressing innovative industries but still making incremental progress. She stated:

I tell people to be patient with anything the U.S. Securities and Exchange Commission (SEC) does. ETFs began 20 years ago, and it is only now that we are just formulating new rules that allow registration of startups without special permission.

Earlier this week, SEC Chairman Jay Clayton declined to tell Congress whether the agency would regulate Facebook's Libra project as a security. This could have implications for the SEC's initiation of regulating cryptocurrencies.

According to a report, Clayton stated at the time:

I am not prepared to make any decision here. Even though France and Germany have announced plans to block the development of Libra, the SEC will continue to adopt an "open policy" towards digital assets.

Peirce also responded, hoping that regulatory agencies will "have more forward-thinking," especially in token applications where there is no clear regulatory status. She previously expressed support for a Bitcoin ETF this year, believing it would encourage more institutional investors to participate in the field. She pointed out:

SEC still "babies" and restrains the launch of ETFs, as if they are still infants. It will take a long time before the Securities and Exchange Commission approves Bitcoin trading.

Nevertheless, Peirce remains confident in the long-term viability of the domestic cryptocurrency industry, stating that the United States remains one of the main targets for startups seeking funding. She emphasized:

A large part of the country's vitality is because we have a well-functioning market. Our capital markets are very robust, and it is where everyone wants to get funding.

Indeed, London recently surpassed New York as the center of fintech investment, with over $200 million invested in startups this year.

According to previous reports from ABM, Peirce has expressed interest in establishing a "non-exclusive safe harbor" for token sales, believing that regulatory agencies must follow market developments, cooperate with foreign counterparts, and determine which regulations are best suited for investors and the market.

Related Readings

- Former Federal Reserve Official: Cryptocurrency Replacing the Dollar is Absurd

- International Monetary Fund: "Stablecoins Could Seriously Disrupt the Current Global Payment Framework"

Join now to get the most comprehensive information on fintech, blockchain insights, and industry examples!