Tokenization of the U.S. bond market continues to grow, with Franklin FOBXX enabling on-chain P2P trading.

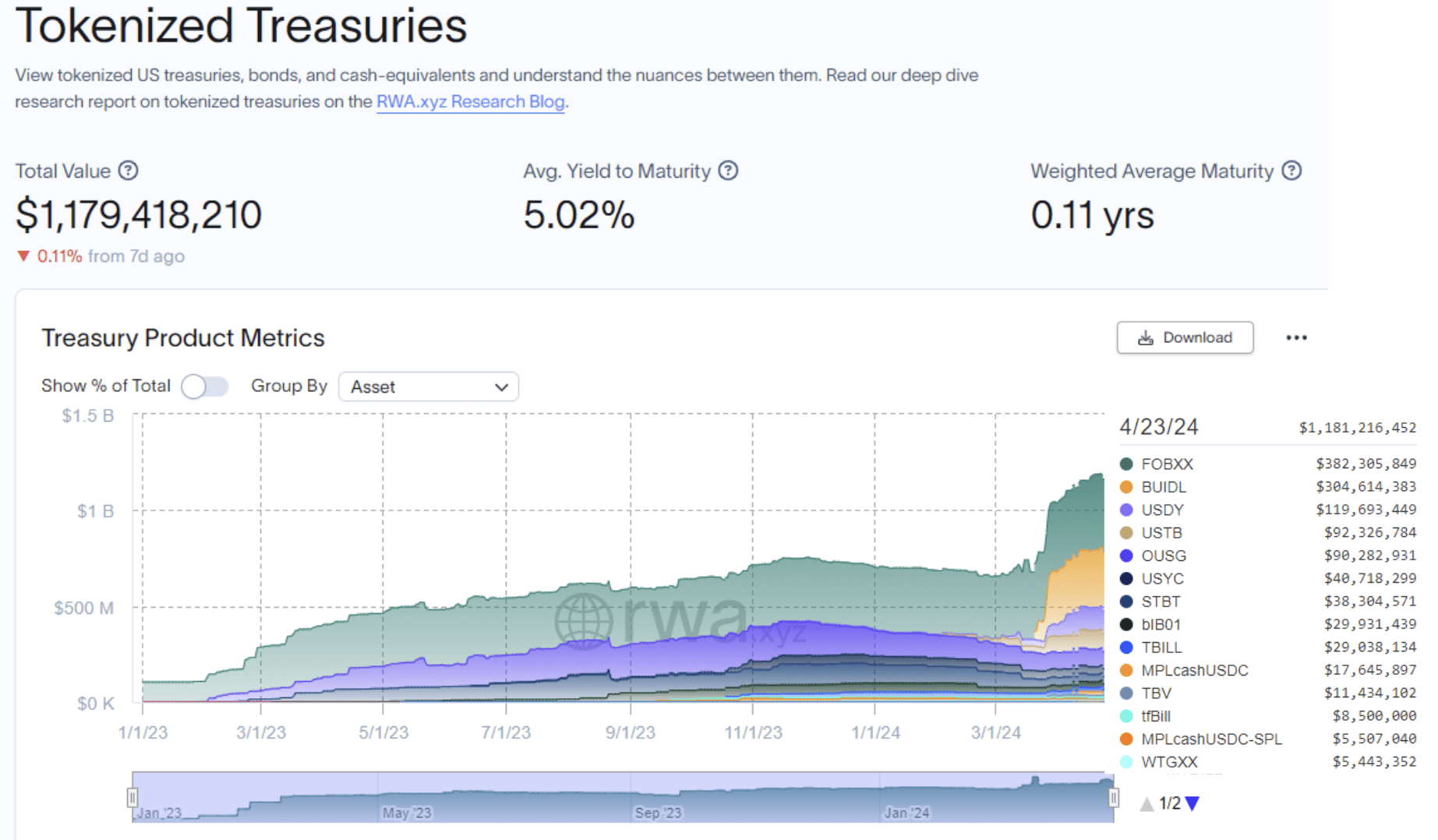

The first blockchain-based fund in the United States, Franklin Templeton's OnChain U.S. Government Money Fund FOBXX, has launched blockchain-based peer-to-peer (P2P) trading. With the addition of BlackRock's USD Digital Liquid Fund BUIDL, the tokenized U.S. bond market has continued to reach new highs, currently standing at $1.18 billion.

Table of Contents

Franklin Templeton is also a Bitcoin spot issuer

Franklin Templeton, headquartered in California, is an asset management company that operates in 155 countries globally, managing approximately $1.6 trillion in assets as of March 31, 2024.

Franklin Templeton is also one of the Bitcoin spot issuers, with the code EZBC, but the current total assets are only $330 million, far below BlackRock's $17.7 billion.

FOBXX opens up P2P trading

Franklin's OnChain U.S. Government Money Fund FOBXX was established on April 6, 2021. The fund invests 99.5% of its total assets in U.S. government securities, cash, and repurchase agreements fully collateralized by U.S. government securities or cash. As of the end of March, the total assets were $360 million, with a total expense ratio of 0.89%.

FOBXX is the first U.S.-registered mutual fund to use a public blockchain for transaction processing and record ownership of shares. Each share of the fund is represented by a BENJI token, and the transfer agent of the fund maintains the formal records of ownership through a proprietary blockchain integration system that utilizes blockchain technology for trading activities. It was initially issued on the Stellar blockchain and expanded to Polygon last April.

To invest in FOBXX, one must have a dedicated on-chain wallet for trading, created by the fund's transfer agent at the time of account opening. Investors can check the fund balance in the wallet through the Benji Investments app, and only this wallet has the right to purchase, redeem, and hold fund shares.

Franklin Templeton announced that FOBXX can now be transferred from one shareholder to another on the public blockchain, enabling peer-to-peer (P2P) transactions.

Tokenized U.S. Treasury Market Continues to Grow

According to the World Asset Tokenization platform RWA.xyz, the market value of the tokenized U.S. Treasury market continues to hit new highs, reaching $1.18 billion. The largest contributor is Franklin's FOBXX, accounting for 32% of the tokenized U.S. Treasury market, while the recent rising star is BlackRock's USD Institutional Digital Liquidity Fund BUIDL, with a market value approaching that of FOBXX.

BUIDL has introduced the smart contract functionality of stablecoin issuer Circle, allowing BUIDL holders to quickly convert their shares into USDC through Circle. This smart contract provides BUIDL investors with near-instant and round-the-clock trade exits, bringing the core benefits of tokenized assets.

Circle introduces smart contracts for BlackRock's BUIDL, will traditional finance adopt the accelerated stablecoin legislation?

Related

- Renowned Flashbots researcher Hasu: "My Binance account has been locked, and I still don't know the reason."

- Airdrop enthusiasts disappointed! Linea core team members leave successively, community worried about token distribution.

- Decrypt's parent company launches prediction market MYRIAD, allowing direct interaction with YouTube, X tweets.