FairWin fund in Ethereum was pointed out as a Ponzi scheme.

According to research, the largest Ethereum contract, FairWin, is putting investors at risk by attempting to lure more users into this scam and continuing to consume a significant amount of resources on the network.

Table of Contents

According to analysis by multiple cryptocurrency social media users on Twitter, they believe FairWin is the fastest-growing Ponzi scheme on Ethereum. On 9/27, blockchain developer Philippe Castonguay also issued a warning:

FairWin is a Ponzi scheme with serious vulnerabilities that put all funds at risk. Please spread the word (especially in Asia) and advise users to withdraw their funds and cease interacting with the contract immediately.

Actions of the Crypto Community Detectives

Harry Denley, security and anti-phishing researcher at Meta Cartel Ventures, compiled detailed content and created a Dune analysis, outlining the attacks on this contract and its creators. He points out:

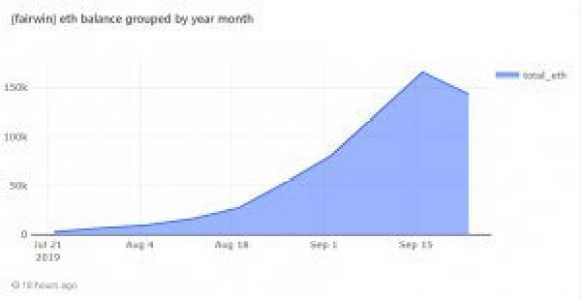

The FairWin contract is a suspicious Ponzi scheme high-yield investment plan that involves a significant amount of ETH.

His analysis provides a Reddit link that collects detailed information on 6 ETH wallets, which account for a high percentage level of around 50% of the deposits sent to the same contract address.

Reddit contributor chutiyabehenchod made detailed allegations on 9/20, stating that FairWin is primarily shared on Chinese social media and blogs, presenting a 5-day high-yield investment program where users can deposit 1-15 ETH and receive a certain percentage of returns. The allegations mention:

While it is decentralized, only 70% of deposits are used to return commissions to earlier deposits. This means that 30% is always held back! Once the account nears depletion, later accounts will incur absolute losses. Currently, 40,000 ETH has been used, with 12,000 allegedly used for unknown fraudulent activities.

Furthermore, community members claim that the contract is easily "owner-controllable," with one commentator suggesting that if the owner does not stop its self-drainage, hackers could conduct independent attacks, and this hacker could even be the owner themselves.

Related Reading

- Google Makes Major Breakthrough in "Quantum Computing," Prompting Concern Among Bitcoin Supporters

- SOLA Coin x VANGPAY New Mobile Payment Solution Offers Up to 8% Cashback on Single Transactions

Join now to get the most comprehensive information on fintech, blockchain insights, and industry examples!

Related

- How to find the whale of meme coins? Experts use NEIROETH to analyze on-chain data and uncover who is behind the scenes.

- Taiwan's Financial Supervisory Commission (FSC) allows professional investors to invest in foreign virtual asset ETFs, Taiwanese institutions may invest in Bitcoin.

- Media Trust Declines! Grayscale Report: Blockchain Predictive Market Has the Potential to Become a Source of Truth