Chinese cryptocurrency holders are mainly middle-aged and young, and they are optimistic about the future of Bitcoin.

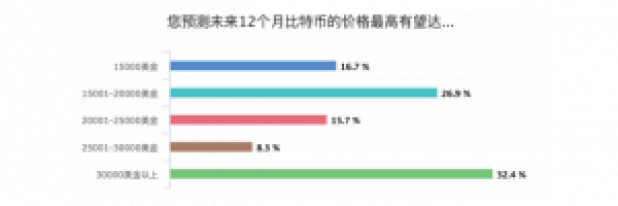

A survey conducted by the cryptocurrency financial services firm Beibao Financial targeting Chinese cryptocurrency investors revealed that they are optimistic about the market outlook. Thirty percent of the surveyed investors predict that the price of Bitcoin is expected to rise to $30,000 within the next 12 months.

Table of Contents

On August 20th, PayPal Financial released the "PayPal Financial 2019 China Cryptocurrency Investor Wealth Report" to the public. According to the report, the majority of surveyed investors hold a positive outlook on Bitcoin in the next 12 months, with some even expressing very optimistic expectations, believing that there will be a doubling in value.

Statistics show that 32.4% of respondents believe that Bitcoin is likely to rise to over $30,000 per coin in the next 12 months, 8.3% believe it will be between $25,000 and $30,000, and 15.7% believe it will be between $20,000 and $25,000 per coin.

Flex Yang, the founder and CEO of PayPal Financial, stated during the report presentation that Bitcoin will experience another halving in 2020. Based on historical data and various models, Bitcoin's price may hit a new high during this halving cycle, and investor expectations may lead to an earlier-than-expected rise.

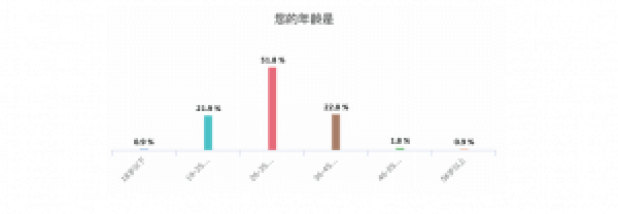

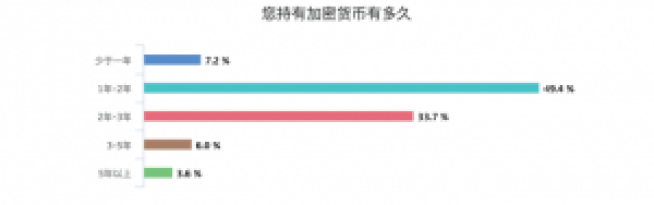

According to the "PayPal Financial 2019 China Cryptocurrency Investor Wealth Report," Chinese cryptocurrency investors are mainly characterized by young, educated, and high-income male individuals. Most investors entered the market within the last three years, but they prioritize Bitcoin and are more willing to hold substantial amounts for the long term.

The report indicates that cryptocurrency holders are primarily young and middle-aged adults, representing a group of financially strong individuals. Among the respondents, 51.8% are between 26 and 35 years old, 21.9% are between 19 and 25 years old, 22.8% are between 36 and 45 years old, and very few cryptocurrency holders are over 46 years old.

The vast majority of surveyed investors have only started holding Bitcoin in the last 1-3 years, accounting for a high percentage of 83.3%, while those who have held cryptocurrency for over 5 years only make up 3.6% of the respondents.

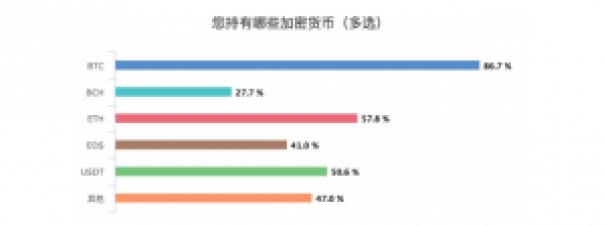

Looking at the distribution of cryptocurrency holdings, Bitcoin remains the most favored investment choice, with 86.7% of respondents holding Bitcoin. The next most recognized cryptocurrencies are Ethereum, stablecoin USDT, and EOS, with holders accounting for 57.8%, 50.6%, and 41%, respectively.

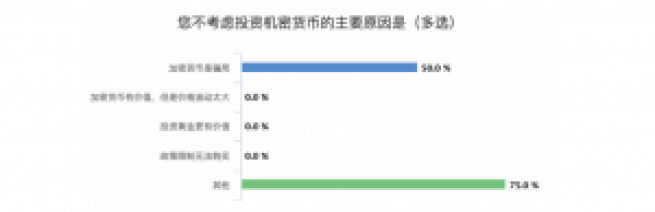

The survey also found significant gaps in education and financial services tailored to cryptocurrency investors, leading some individuals to maintain a negative view of cryptocurrencies. The survey questionnaire revealed that among those who are not considering investing in cryptocurrencies, 50% of respondents still believe that cryptocurrencies are scams.

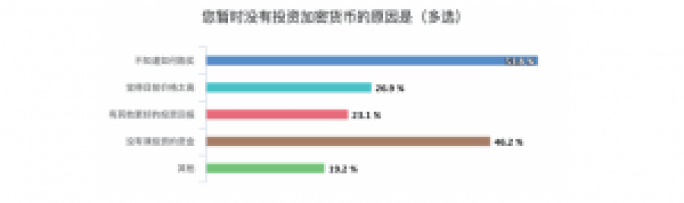

Among those who have the intention to invest in cryptocurrencies but have not yet done so, over half (53.8%) of the investors stated that a major reason for not owning cryptocurrencies is due to not knowing how to purchase them.

The original article was published on the partner site PANEWS

Related Reading

- Blockchain Education Initiative: University of California to Launch Blockchain Courses

- CoinMarketCap Announces Updates to Market Capitalization Ranking Criteria

Join now to receive the most comprehensive fintech information, blockchain insights, and industry examples!