Many companies are rushing to adopt Bitcoin as a reserve asset. Is this a focus on their core business or a resurrection by borrowing a corpse?

Since the U.S. listed company MicroStrategy introduced Bitcoin as a reserve asset and achieved significant success, more and more companies are adopting the same strategy. How have the performances of these companies been since buying Bitcoin? And how should investors evaluate the value of these companies?

Table of Contents

MicroStrategy, the Bitcoin Development Company

MicroStrategy is the company with the most Bitcoin holdings among all publicly traded companies. Since entering the Bitcoin market in 2020, the company has continuously purchased Bitcoin using its own cash, issuing bonds, and issuing new shares. As of now, they hold 244,800 Bitcoins. In February of this year, MicroStrategy rebranded itself as a "Bitcoin development company." Its founder, Michael Saylor, is known as a top Bitcoin Hodler advocate. Saylor believes that the strategy of buying Bitcoin can increase the company's visibility. The increase in the company's software revenue allows MicroStrategy to purchase more Bitcoin, creating a positive cycle. He emphasizes that "continuously buying Bitcoin is a way of exiting," and in his view, the only way is to keep buying and holding Bitcoin.

MicroStrategy Founder Michael Saylor: Continuously buying Bitcoin is a way of exiting

What does MicroStrategy's "Bitcoin Yield" represent?

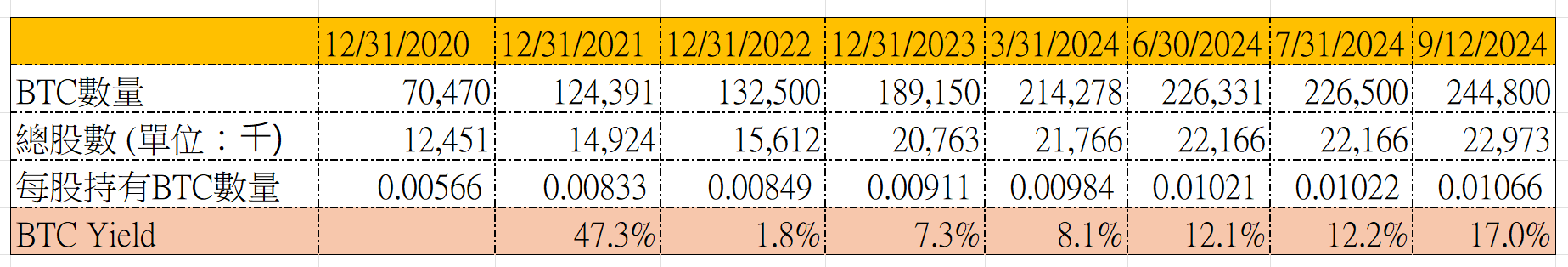

MicroStrategy has introduced a new key performance indicator for its Bitcoin strategy called "Bitcoin Yield" BTC Yield. Its "Bitcoin Yield" so far this year is 17%, with a target of 4% to 8% annual growth over the next three years.

To facilitate understanding of the "Bitcoin Yield," MicroStrategy calculates the amount of Bitcoin held by the company since the end of 2020, the diluted outstanding shares of MicroStrategy, all actual shares of common stock, and any additional shares generated through the conversion of all convertible securities, exercise of all stock options, and settlement of all restricted and performance stock units. We can see that the value has increased from 0.00566 at the end of 2020 to 0.01066 on September 12, 2024. In other words, if you bought a share of MicroStrategy stock at the end of 2020, the amount of Bitcoin you hold has almost doubled, increasing by nearly 90%.

MicroStrategy's "Bitcoin Yield" does not consider Bitcoin price fluctuations. From the perspective of MicroStrategy shareholders, the company believes that this KPI can help investors understand and decide on purchasing Bitcoin through issuing additional common shares or convertible to common shares. In the last financial report, MicroStrategy stated that the goal for the next three years is to grow at a rate of 4% to 8% annually. In other words, the amount of Bitcoin held by MicroStrategy shareholders will grow at a rate of 4% to 8% annually.

The "Bitcoin Yield" excludes Bitcoin price and MicroStrategy stock price fluctuations. Looking at this KPI from a Hodler's perspective seems to echo Saylor's statement that "continuously buying Bitcoin is a way of exiting."

Note 1: BTC Yield after 2024 is calculated based on the year-end 2023, representing the year-to-date change compared to the end of the previous year.

Note 2: MicroStrategy conducted a 10-for-1 stock split on August 7, 2024, so the actual total number of shares on September 12 is 229,732 thousand shares. For consistency, it is presented as 22,973 thousand shares.

Other Public Companies Buying Bitcoin

Miner Marathon Digital Adopts a Full HODL Strategy

Marathon Digital, a mining company, is the second-largest company in terms of Bitcoin holdings among publicly traded companies. According to data from Bitcoin Treasuries, Marathon Digital currently holds 26,200 Bitcoins. The company mines Bitcoins itself and in August announced a full HODL strategy. Besides holding all mined Bitcoins, Marathon Digital, following MicroStrategy's lead, issued $250 million in convertible bonds to buy more Bitcoin.

Miner Marathon Digital announces HODL strategy, buys an additional $100 million in Bitcoin, issues convertible bonds

Block Launches Bitcoin DCA Plan

Block, the payment platform owned by Twitter's founder Jack Dorsey, formerly known as Square, announced that starting from April, they will invest 10% of the monthly gross profit from their Bitcoin products into purchasing Bitcoin. They currently hold 8,211 Bitcoins, ranking seventh among publicly traded companies.

Block launches Bitcoin DCA plan, invests 10% of gross profit monthly in purchasing BTC

Japanese MicroStrategy Metaplanet

Metaplanet, a Japanese conglomerate that started as a hotel business, including Web3 consulting business, decided to start buying Bitcoin after receiving investments from various capital institutions and individuals such as Sora Ventures and 210k Capital this year. They aim to generate income through holding Bitcoin.

Buying 1 billion yen of BTC, Metaplanet's stock price in Japan has surged nearly 90%! Sora Ventures acquires to create "Asian MicroStrategy"

Metaplanet currently holds 398.8 Bitcoins, ranking 27th among publicly traded companies. Additionally, Japan's tax system has made Metaplanet an attractive investment option, as the capital gains tax on cryptocurrencies in Japan can be as high as 45%, starting from 5% based on annual income, compared to a maximum of 20% for stocks.

Why is Japan's crypto tax system favorable for the Japanese version of MicroStrategy, Metaplanet's stock price?

How to Evaluate the Value of These Companies?

Bitcoin as a Percentage of Company Market Cap

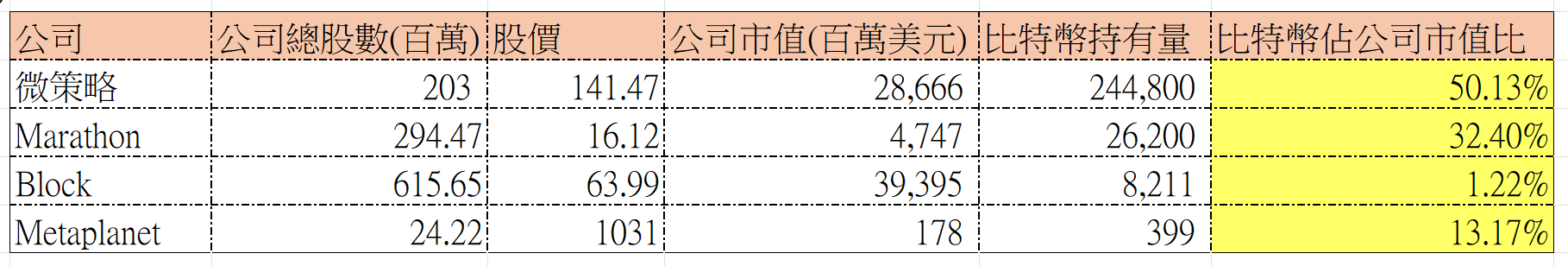

If we look at these companies from the perspective of Bitcoin holdings, the fairest criterion would be the percentage of Bitcoin to the company's market cap. The table below, based on the Bitcoin price of $58,700 before the deadline on September 16, calculated using the USD to JPY exchange rate of 140.50, compiles the total outstanding shares of each company's stock and the amount of Bitcoin held by these companies according to Bitcoin Treasuries.

The table selected four companies with different business characteristics. Naturally, MicroStrategy has the highest percentage of Bitcoin to company market value, reaching 50%. Marathon Digital follows with 32.4%, Metaplanet at 13.17%, and Block at only 1.22%.

This data is considered to represent the significant proportion of Bitcoin in their business.

Focus on Core Business or Resurrection?

MicroStrategy is a U.S. company that provides business intelligence, data analytics, mobile software development, and cloud computing services. Founded in 1989, it went public in 1998 and competes mainly with Salesforce, IBM's Cognos, and Oracle's BI platform.

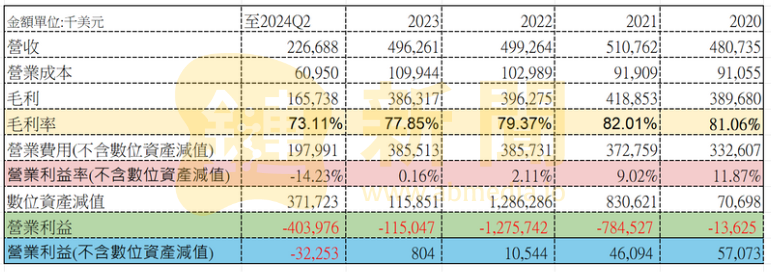

By examining MicroStrategy's financial reports from 2020 to the first half of 2024, it is evident that MicroStrategy's software gross profit has consistently remained above 70%, making it a profitable company.

Because MicroStrategy considers purchasing Bitcoin as an important part of its development strategy, the financial statements include the impact of impairments on digital asset valuation, which is listed as an operating expense. Therefore, expenses related to Bitcoin purchases, custody, etc., are included in administrative expenses.

However, even after excluding the impact of impairments on digital assets, MicroStrategy's operating profit margin has declined from 11.87% in 2020 to a negative value this year. The operating profit for the first half of this year, excluding the impairment of digital assets, was -$32.25 million, indicating a continuous decline in its software business.

If we use the percentage of Bitcoin to the company's market cap to evaluate, should the remaining half of the company's market value be borne by the software business? Or has MicroStrategy early on declared its transformation into a "Bitcoin development company," so it doesn't need to focus much on the software business and can rely on Bitcoin price increases to fill the gap?

Two other companies previously dubbed "zombie companies," Japanese lodging business Metaplanet and U.S. health tech company Semler Scientific, have gradually emerged from their predicaments this year by adopting MicroStrategy's Bitcoin strategy, resulting in significant increases in stock prices. The executives of these companies shared their transformation experiences at the Bitcoin 2024 conference in Tennessee.

Corporate resurrection through Bitcoin! Metaplanet and Semler Scientific's path to revival

Companies like Marathon Digital are involved in Bitcoin mining, and payment provider Block operates Bitcoin payments, with products revolving around Bitcoin's existence. Both companies have businesses closely related to Bitcoin.

For companies whose valuation relies solely on the increase in Bitcoin prices, while attracting attention with Bitcoin, whether their core business continues to grow is also an important factor for investors to consider.

Related

- South Korea's National Pension Service denies indirect investment in cryptocurrency assets, claims it only tracks the MSCI index.

- Ethereum spot ETF options application faces setback, SEC delays decision to November

- China cuts interest rates and injects a large amount of liquidity, global stock markets rise together, and Bitcoin surpasses 64K