Bitcoin falls again with U.S. stocks, lacking strong momentum in the crypto market

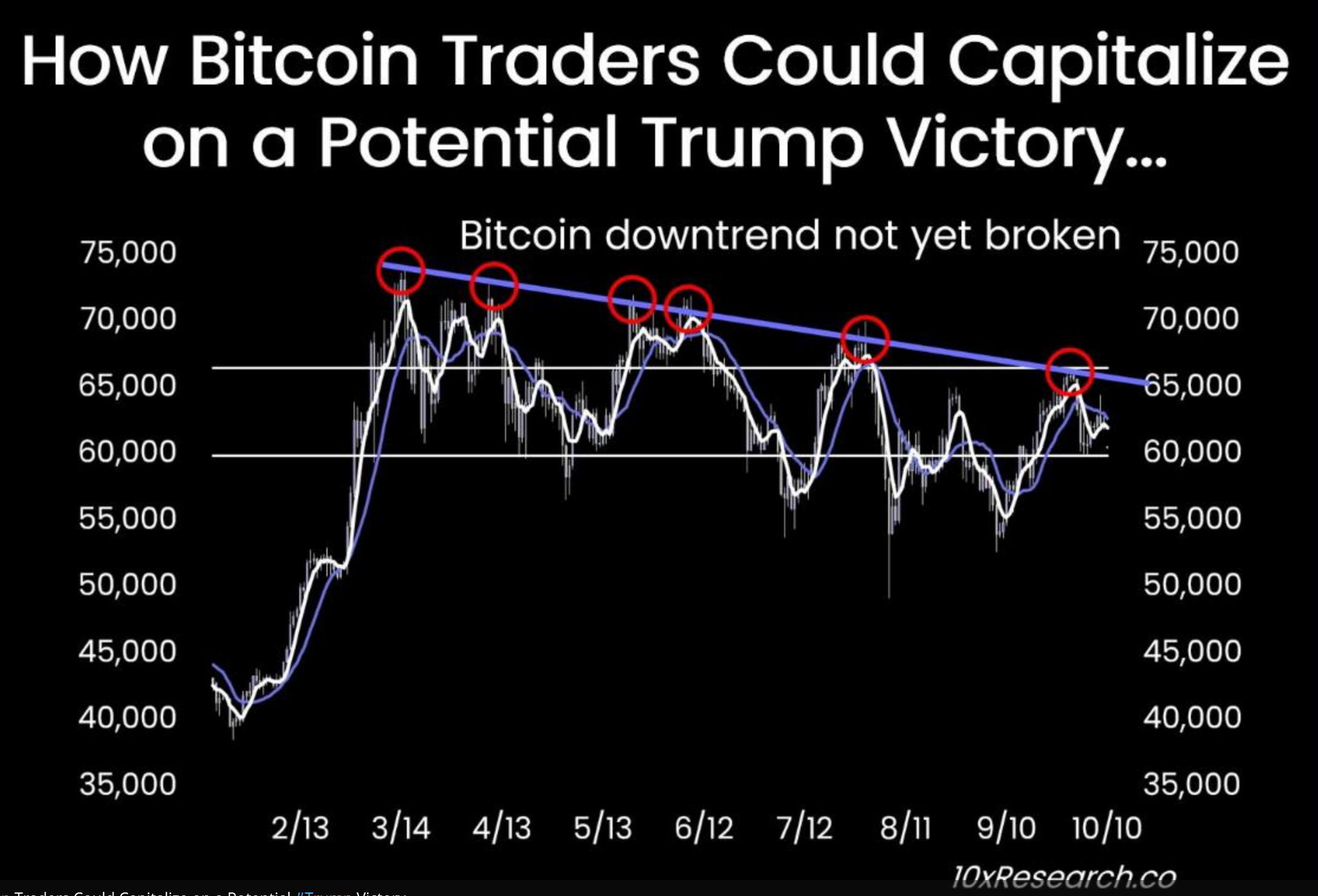

Bitcoin fell alongside the U.S. stock market after inflation data in the U.S. came in slightly higher than expected and weekly jobless claims surged. 10x Research believes that Bitcoin has yet to decisively break above its recent downtrend line, and while it may be premature to abandon hope for a fourth-quarter rebound, effective risk management is crucial given the current lack of market momentum.

Table of Contents

Weakening Employment, CPI Slightly Higher Than Expected

Yesterday, the U.S. reported that the Consumer Price Index (CPI) for September rose by 2.4% year-on-year, higher than the market's expectation of 2.3%. Meanwhile, the core CPI, which excludes food and energy costs, increased by 3.3% year-on-year in September, also surpassing market expectations and the previous value of 3.2%. However, the annual inflation rate still recorded its smallest increase in over three years, reflecting a broader trend of slowing inflation. Another report showed that for the week ending October 5th, weekly jobless claims rose to 258,000, primarily affected by Hurricane Helen and the Boeing strike.

Alex Ebkarian, Chief Operating Officer of Allegiance Gold, stated that the Consumer Price Index report did not bring significant surprises, and the employment data indicated a soft trend, suggesting the possibility of a rate cut by the Federal Reserve.

According to the CME FedWatch tool by the Chicago Mercantile Exchange, the market currently expects an 86.9% chance of a rate cut by the Federal Reserve next month by 1 basis point, while the expectation of a 2-basis-point cut has completely disappeared.

Bitcoin Dips Below 59K, Market Lacks Strong Momentum

Following slightly higher-than-expected U.S. inflation data and a significant increase in weekly jobless claims on Thursday, Bitcoin, along with the U.S. stock market, experienced a decline.

BTC dropped below 59K last night, marking a new low since 9/17. Although analysts generally believe that the downturn is temporary and emphasize the close correlation between the performance of cryptocurrencies and the U.S. stock market, expecting the cryptocurrency market to follow suit as the stock market recovers.

As BTC briefly fell below 60K, will "devaluation trading" lead Bitcoin into "Uptober"?

However, 10x Research believes that Bitcoin has not yet formally broken through the recent downtrend line. Currently, the cryptocurrency market lacks sufficient wind to keep the sailboat on course, and this "wind" comes from market structure – encompassing trading volume, funding rates, stablecoin minting, ETF liquidity, and more. Without strong momentum, cryptocurrencies remain within a narrow trading range. While it may be too early to abandon hope for a rebound in the fourth quarter, effective risk management is crucial given the current lack of market drive.

Related

- Bitcoin falls again with U.S. stocks, lacking strong momentum in the crypto market

- Visa earns $7 billion in the US annually! The Department of Justice accuses Visa of illegal payment monopoly. Is this an opportunity for blockchain?

- Institutions differ from what you think! VanEck: Janet Yellen's election is more favorable for Bitcoin