Bitwise presents three arguments to the SEC and states, "The market is ready for a Bitcoin ETF."

The cryptocurrency asset company Bitwise stated in a report submitted to the U.S. Securities and Exchange Commission that three major changes in the past two years have "significantly improved" the Bitcoin market, and believes that the timing is ripe for the launch of a Bitcoin ETF.

Table of Contents

- Efficient spot market

- Institutional custody of crypto assets

- Growing futures market

Bitwise is currently applying to the U.S. Securities and Exchange Commission for a Bitcoin ETF. If approved, it will be listed on the New York Stock Exchange and become the first fully regulated Bitcoin exchange-traded fund in the United States.

Bitwise points out that their previous report detailed the fake trading volumes on cryptocurrency exchanges, which has helped reshape the crypto industry and had a positive impact. The report states:

After our publication of the study showing "95% of Bitcoin trading volume is fake," the report was widely covered in the media. This includes The Wall Street Journal, CNBC, Bloomberg, Forbes, The Economist, and all major blockchain media, as well as over 3.55 million Google searches for "Bitwise fake volume."

Previous reports also indicate that the report prompted responses from industry leaders such as Binance and CoinMarketCap, leading to the launch of the "Data Accountability and Transparency Alliance" (DATA) initiative to improve their data.

The report highlights:

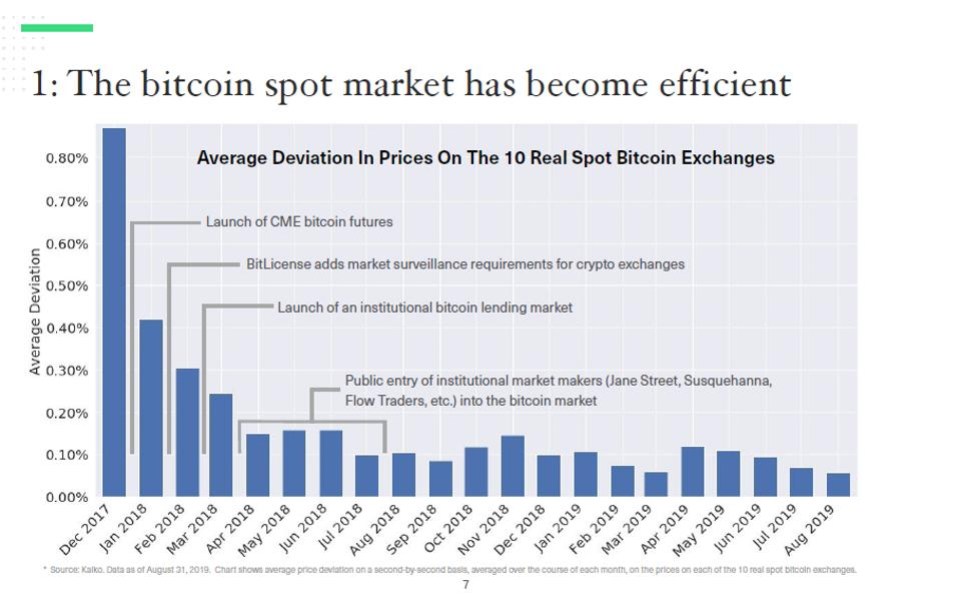

The widespread awareness of past fake trading volumes in Bitcoin has led to increased market efficiency over the past year, with the "spread" of Bitcoin across exchanges becoming smaller.

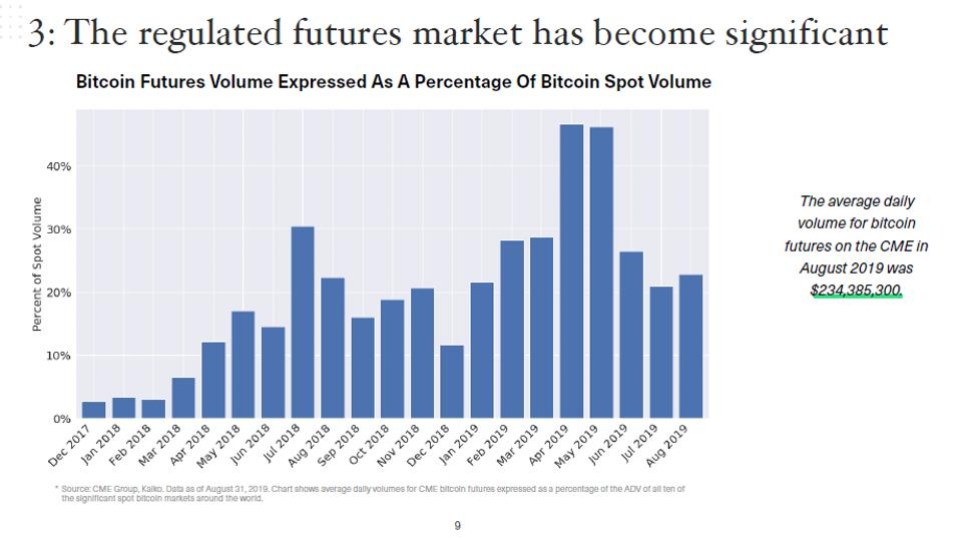

The report also mentions that the Bitcoin futures volume on the regulated Chicago Mercantile Exchange has significantly increased, with Bitwise considering this as a significant and regulated market, making CME Bitcoin futures an important part of the real Bitcoin market.

Although Grayscale Investments' Bitcoin Investment Trust fund BIT has been trading over-the-counter on the OTC Markets Group since 2013, the U.S. Securities and Exchange Commission rejected nine other Bitcoin ETFs in August 2018.

The report notes that on October 14, the U.S. Securities and Exchange Commission is expected to approve or reject the ETF proposal submitted by Bitwise.

Related Reading

- CME Bitcoin Index Providers Receive First Cryptocurrency License in the EU

- North Korea Reportedly Developing Its Own Cryptocurrency to Evade U.S.-Led Global Financial System

Join now to get the most comprehensive information on fintech, blockchain insights, and industry examples!