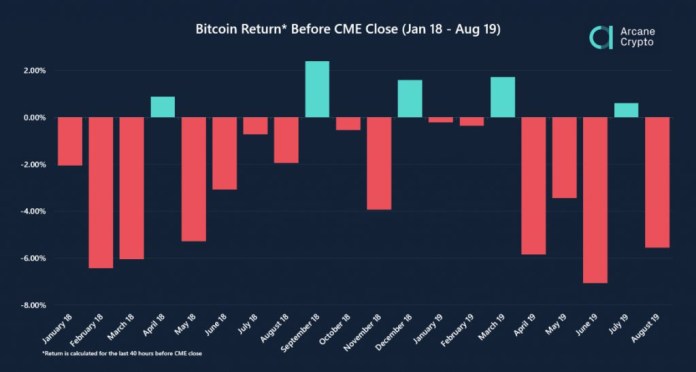

Research shows that 75% of Bitcoin futures contracts experience a decline before settlement.

The cryptocurrency market is perceived as easily manipulated due to its relatively small capitalization. Recent research also indicates that CME futures contracts are significantly influencing the price of Bitcoin.

Back in 2017, when CME announced the launch of Bitcoin futures, the group's chairman emeritus, Leo Melamed, candidly stated:

We will tame Bitcoin.

According to reports, the cryptocurrency research firm Arcane Research has conducted an in-depth study on the impact of Bitcoin futures. The data suggests that suspicions of market manipulation may be valid.

Table of Contents

Bitcoin Futures Always Decline Before Settlement

Between January 2018 and August 2019, when Bitcoin futures were launched, the average daily increase in Bitcoin price was about 0.04%. In contrast, on settlement days on the CME, the price of Bitcoin typically dropped by an average of 1.99%.

Furthermore, the study found that out of the total of 20 settlement days on the CME, only 5 days saw an increase in Bitcoin price. Also, whenever Bitcoin had a significant monthly increase, the decline before the closing settlement seemed to be even worse.

As of this year, on the settlement days of April, May, June, and August, there were significant declines.

- April 2019: -5.86% decline before closing settlement, 1.86% increase in the month.

- May 2019: -3.44% decline before closing settlement, 3.96% increase in the month.

- June 2019: -7.08% decline before closing settlement, 2.28% increase in the month.

- August 2019: -5.56% decline before closing settlement, 0.12% increase in the month.

These data indicate that the futures market has a significant impact on the price movement of Bitcoin.

Is It Really Manipulation?

From the above data, it is evident that the futures market is indeed manipulating the price of Bitcoin. The substantial decline before each settlement, especially on the CME, indicates some level of price manipulation, which is unlikely to be coincidental.

However, purely based on data, the decline before settlement may also be a result of consensus among investors, traders, and even a large number of retail investors, factors not considered in the research data.

According to a previous ABM report, after the launch of Bakkt's "physically settled" Bitcoin futures, the market response was tepid, and Bitcoin even saw a significant decline, raising questions about whether the so-called "institutional market" would benefit Bitcoin.

Unlike the CME, Bakkt's "physically settled" futures use actual Bitcoin as the settlement unit, which may lead to new market dynamics.

Related

- Tether: USDT Injects New Life into High Inflation Countries, the Best Partner for the US Dollar

- Bernstein prediction: If Trump wins, BTC will reach $90,000 by the end of the year, but if Biden wins, it will drop to $30,000.

- Another month of endurance? Historical data: Bitcoin always falls in September and rises in October.