Meta's first-quarter financial report shines, will further expand AI capital expenditure

Social media giant Meta announced first-quarter earnings that exceeded analysts' expectations in terms of revenue and profit. However, due to a slight downward revision in its financial forecast and the need to further expand AI capital expenditures, Meta's stock price plummeted by 15% in after-hours trading.

Table of Contents

Ad Revenue Continues to Shine, But Metaverse Still in the Red

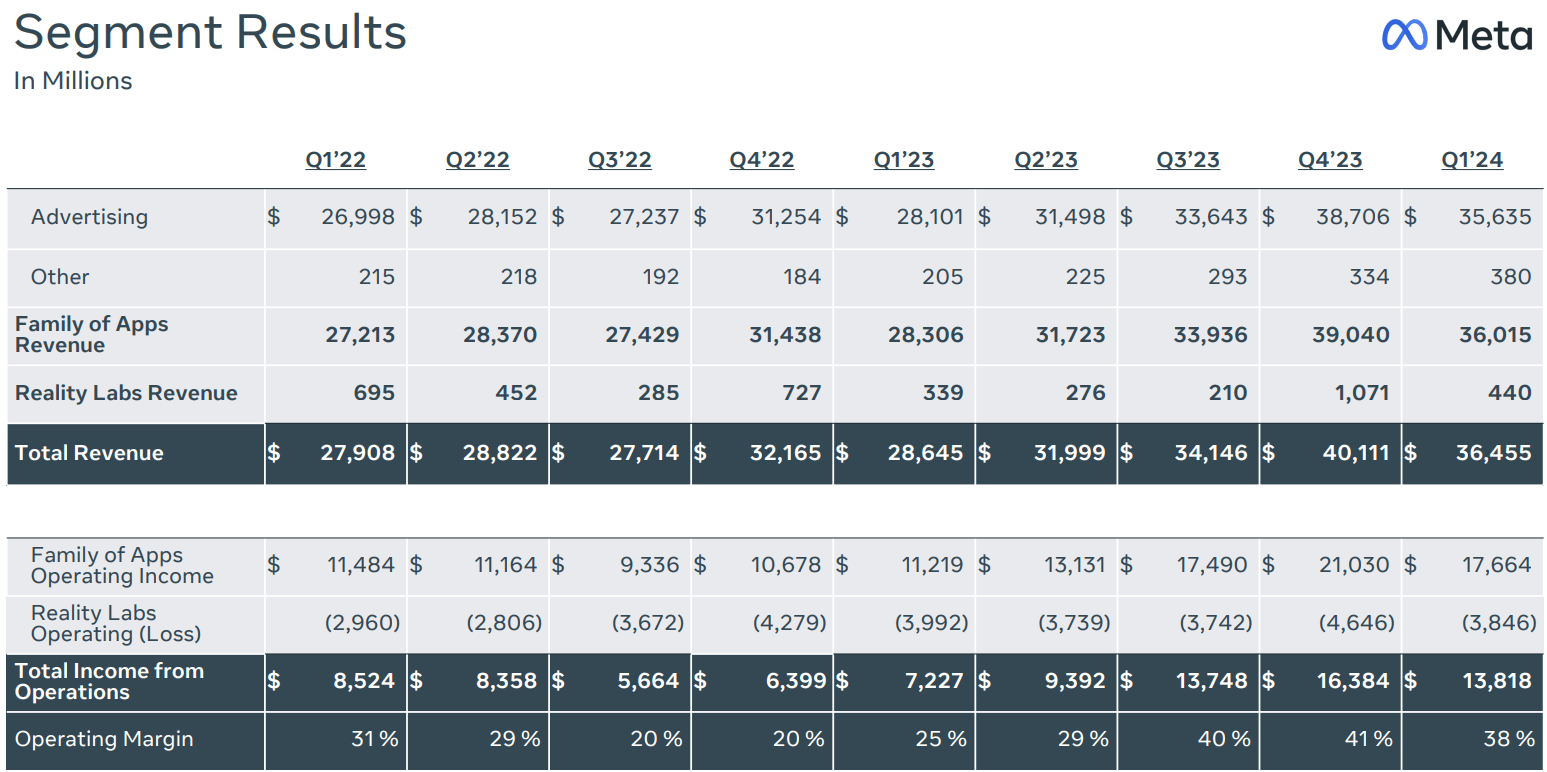

With the online advertising market rebounding, Meta's revenue for the quarter grew by 27% to $36.5 billion, up from $28.6 billion in the same period last year, making it the fastest growth rate since mid-2021. Costs also decreased by 6%, resulting in an operating profit margin of 38%, with earnings per share of $4.71, all surpassing analysts' expectations.

Metaverse Continues to Burn Cash, Expands AI Capital Expenditure

However, Meta's beloved metaverse business, led by CEO Mark Zuckerberg, continues to struggle, with Meta's Reality Labs division still incurring a $3.8 billion loss. The CFO stated that due to ongoing product development efforts and further investments in expanding the ecosystem, they anticipate a significant increase in operating losses compared to the same period last year.

Meta expects full-year 2024 capital expenditures to fall between $35-40 billion, higher than the previous estimate of $30-37 billion, to actively invest in AI research and product development.

Financial Forecast Falls Short, Meta Plunges 15% After Hours

Meta anticipates second-quarter revenue to range between $36.5-39 billion, lower than analysts' expected $38.3 billion.

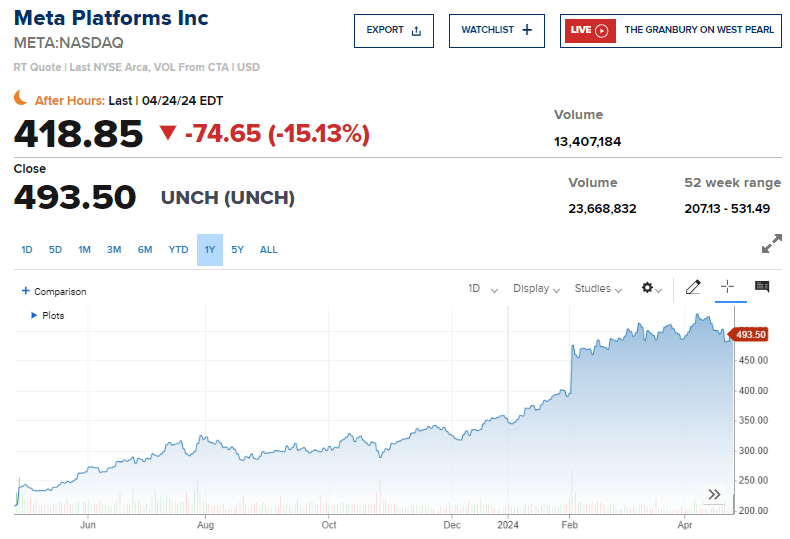

Previously, Meta continued to burn cash even when the outlook for the metaverse was bleak, with its stock price falling below $90 at the end of 2022. Subsequently, Meta focused on reclaiming digital advertising market share and implementing plans to precisely target ads using AI, which increased ad revenue and drove the stock price to over $500.

However, perhaps due to the stock price already being too high or investors' expectations for Meta being too lofty, Meta plunged 15% after hours following the financial report release.

Related

- Binance Wealth sets a precedent in the industry by introducing a cryptocurrency asset management solution for wealth managers.

- Visa's annual report warns against the latest sophisticated scam tactic "digital skimming"

- Bridgewater Founder Dalio: China Moving Away from Capitalism, Investing in China Still Tricky