BlackRock's IBIT sees 71 consecutive days of net inflows halted, while Grayscale's GBTC continues to set a record for consecutive net outflows.

According to Bloomberg's ETF analyst Eric Balchunas, BlackRock's Bitcoin spot ETF IBIT did not see any inflows yesterday, ending its streak of consecutive inflows at 71 days. Meanwhile, Grayscale's GBTC continues to set records with 72 consecutive days of outflows, unmatched by any others.

ITS OVER: $IBIT took $0 yesterday and as such it's daily inflow streak has ended at 71 days, shy of all time record but one for the ages and utterly smashing the record for a new launch. For context, $GLD had awesome launch and its 'out of the gate' inflow streak was 3 days. https://t.co/ZwZSKmnqD5

— Eric Balchunas (@EricBalchunas) April 25, 2024

Table of Contents

IBIT Ends at Tenth, Records 71 Consecutive Days of Net Inflows

According to Bloomberg's ETF analyst Eric Balchunas, the record for consecutive days of net inflows for the iShares Bitcoin Physical ETF (IBIT) ended yesterday as there were no new fund inflows, halting its streak at 71 days. The top spot now belongs to the JPMorgan Equity Premium Income ETF (JEPI) with an impressive 160 consecutive days of net inflows since its launch in 2020.

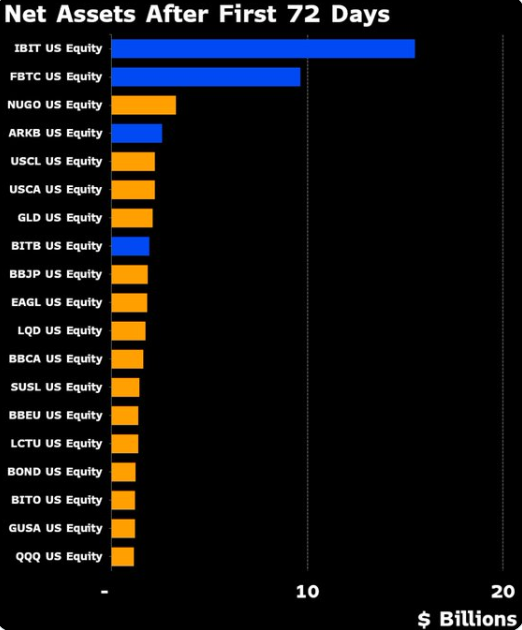

However, Balchunas mentioned that IBIT still has the potential to set other records. He shared the total ETF assets in the 72 days before listing, with iShares' IBIT leading the pack, followed by Fidelity's FBTC. Other Bitcoin physical ETFs such as ARK's ARKB and Bitwise's BITB also made the list, highlighting the current fervor in the market.

Among all 10,698 registered funds in the U.S., including ETFs, mutual funds, and closed-end funds, IBIT ranks second in terms of flows since the beginning of the year.

GBTC Records 72 Consecutive Days of Outflows

Additionally, Grayscale's Bitcoin Physical ETF (GBTC) continues to set new records with 72 consecutive days of outflows, unmatched by any other ETF.