The Federal Reserve is set to start a rate-cut cycle this week. Will Bitcoin follow gold to reach new highs?

The Federal Reserve is set to hold a meeting this Tuesday and announce its interest rate decision in the early hours of 9/19 Taiwan time. Last week, with expectations of a rate cut, all three major U.S. stock indexes closed higher, with the S&P 500 up 4% for the week and the Nasdaq soaring 5.9%, marking their best weekly gains of the year. Gold hit new highs last week. As for Bitcoin, often referred to as digital gold, can it keep pace with gold and benefit from this wave of market liquidity?

Table of Contents

The Federal Reserve to Hold Meeting This Week

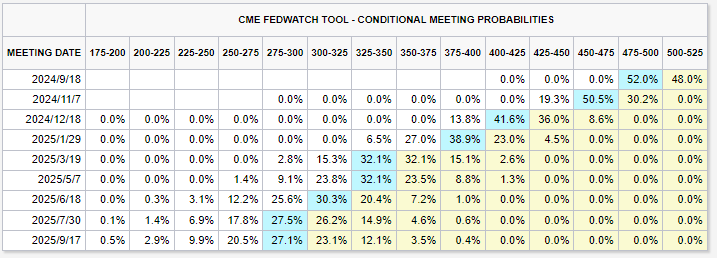

The Federal Reserve is set to hold a meeting on the 17th and 18th, with the interest rate decision scheduled to be announced in the early hours of September 19th in Taiwan time. Market opinions are divided on whether there will be a cut of 0.25% or 0.5%. Nick Timiraos, a journalist known as the "Fed Whisperer" from The Wall Street Journal, revealed that recent data has provided mixed signals on the U.S. economy, and policymakers are evaluating whether to cut rates by 0.25% or 0.5%. According to the CME FedWatch Index, investors are torn between a 0.25% or 0.5% cut, with the probability of a 0.5% cut currently at 52%.

BTC Surges Above $60,000, ETH/BTC Drops Below 0.04

Bitcoin surged to as high as $60,625 over the weekend, with a 7.4% increase in the past seven days. The Bitcoin spot ETF saw a net inflow of $263 million on September 13th, primarily driven by $102 million net inflow from Fidelity's FBTC and $99.3 million net inflow from Ark's ARKB.

However, Ethereum's performance has been relatively weak, with the ETH/BTC exchange rate dropping below 0.04 to a new low since April 20, 2021, currently reported at 0.03919. This rate reached a historical high of 0.1238 in January 2018 and a low of 0.01615 in September 2019.

Rate Cut Train Set to Depart, Gold Hits New Highs, Can Bitcoin Keep Up?

It appears that the start of this rate cut cycle is imminent, but which assets will benefit?

Gold has hit new all-time highs with the help of rate cut discussions and a weakening U.S. dollar, as inflows of funds have pushed holdings of the world's largest gold exchange-traded fund, SPDR, to their highest levels since early January. Analysts from Deutsche Bank stated:

The market still expects the Federal Reserve to cut rates by 100 basis points before the end of the year, and due to the aggressive rate cut expectations in the coming months, gold prices may continue to rise.

As for Bitcoin, often referred to as digital gold, can it follow gold's lead and reach new all-time highs? According to previous reports, analysts believe that the outcome of the U.S. presidential election will significantly impact Bitcoin's trajectory. Standard Chartered predicts that if Trump wins, the price could reach $125,000; if Harris wins, it could hit $75,000. Bernstein, on the other hand, believes that a Trump victory could see Bitcoin reaching $90,000 by the end of the year, but a Harris win would drop it to $30,000.

Standard Chartered: Bitcoin to Hit New Highs by Year-End, Regardless of U.S. Presidential Election Outcome

Bernstein Prediction: Trump Victory to Reach $90,000 BTC by Year-End, Harris Win to Drop to $30,000