TON lockup value plunges by 53%, Telegram DeFi protocol assets hemorrhage, TON staking decreases

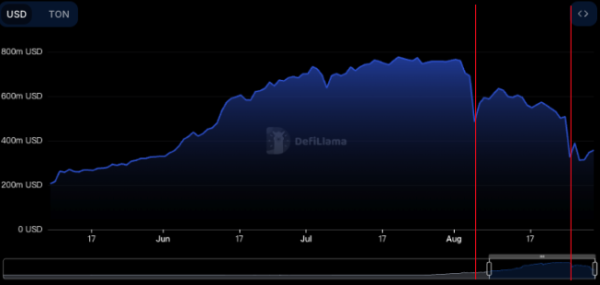

The founder of Telegram was arrested in Paris and indicted by French regulators for serious charges, including assisting in illegal transactions and organized crime, which could result in a maximum sentence of ten years. The Ton blockchain, which serves as a significant digital financial channel for Telegram, has also been deeply affected. According to DeFiLlma data, the Total Value Locked (TVL) on the Ton chain reached a peak of $700 million in July, but has since dropped to $350 million after the Telegram case.

From the data, it can be observed that the decrease in Ton TVL occurred a month ago, and has further declined by 29% after the Telegram case, plummeting by 53% since August 30.

Why was Pavel Durov, the founder of Telegram and the visionary leader of TON, arrested? It's not about freedom, but rather about crime and cryptocurrency.

Table of Contents

TON DeFi Protocol Bleeds Out, Telegram Case Causes Overall Contraction

According to DeFiLlma, the average increase and decrease in TVL of TON's 20 DeFi protocols post Telegram case was -18.10% over 7 days, indicating a downward trend in TVL for most projects during this period. The 30-day average TVL change was -16.73%, showing a continued decline in TVL for most projects, albeit slightly less than the 7-day average.

Chart Notes: Total Value Locked (TVL) of various blockchain protocols and their percentage changes in 1 day, 7 days, and 1 month. The blue bars represent TVL in millions, while the line graph shows percentage changes over different time intervals:

- TVL: Top protocols by TVL include Tonstakers, STON.fi, and DeDust.

- 1-day change (red line): Protocols like TON Hedge and STON.fi show significant positive changes, while others exhibit slight or negative trends.

- 7-day change (green line): Most protocols show a negative trend in the past week, indicating recent challenges.

- 1-month change (purple line): Different protocols perform differently, with some like Cygnus Finance and DAOLama showing significant positive trends over a longer period.

TON PoS Staking Sees Massive Exodus

According to TON Explorer, PoS TON staking quantity was 296 million TON on 8/27, drastically dropping to 152 million TON on 8/28, with staking APY quickly adjusted from the original 3-4% to 6.9%.

TON Network Halts Block Production, Emergency Inspection of Node Equipment

In recent days, the Ton blockchain experienced severe block production halts several times. According to the TON team, the failures were caused by abnormal spikes in transaction activity, disrupting network consensus.

The team stated that the network overload was due to the DOGS token, leading to the introduction of node penalty mechanisms to reduce non-functioning nodes. Additionally, they have begun investigating node equipment specifications in various locations to revitalize the network.

After the arrest of Telegram founder: TON resumes block production seven hours after halt, momentarily losing consensus

Related

- UBS launches tokenized investment fund uMINT on Ethereum

- Privacy blockchain project Nillion raises $25 million to promote the application of "blind computing" technology

- EigenLayer's EIGEN token will be transferable on September 30th. Daily Coin Research: Being criticized now is better than being unnoticed.