Uniswap launches Layer 2 designed for DeFi, data reveals Unichain may lead to increased Ethereum inflation.

Ethereum DeFi giant Uniswap recently announced the launch of an Ethereum Layer 2 Unichain testnet, built using the developer tools OP Stack provided by Optimism. This move indicates that the DEX, which accounts for over 15% of Ethereum network fees, will shift transaction execution to Layer 2, resulting in significantly reduced transaction costs and delays. Additionally, Unichain will join Optimism's Superchain universe to share liquidity. The technical documentation also mentions user-friendly keywords like account abstraction; however, this could be a warning sign for the Ethereum mainnet.

Table of Contents

Why Build Your Own Layer 2? Unichain: Finding the Balance Between User Experience and Decentralization

Previously, it was mentioned that 90% of Ethereum's transaction fees occur on decentralized exchanges, with Uniswap alone accounting for 15% in the first half of 2024. Uniswap, as the most successful DeFi protocol, has processed $2.4 trillion in transactions over the past six years with millions of users. So why would Uniswap move transaction execution to Layer 2 from the mainnet?

Uniswap has pointed out that the biggest drawback of the Ethereum mainnet is its user-unfriendliness, evident in the data showing a block time of approximately 12 seconds. In comparison, public chains like Solana, which are touted as Ethereum killers, have reduced block times to 400 milliseconds. On the other hand, fees are also a weakness of Ethereum, and Uniswap directly states that moving transaction execution to Layer 2 can save over 95% of transaction fees.

However, Ethereum also has its advantages. Many protocols still remain on Ethereum mainly because it is the most stable public chain that has been verified over the longest period of time. Emerging public chains like Solana and Ton have faced blockage due to stopping block production when facing high transaction volumes. As the first public chain capable of running smart contracts, Ethereum's stability, security, and decentralization are reasons why it is difficult to beat. In terms of regulation, Ethereum has also passed the SEC's scrutiny, successfully listing spot ETFs, opening the door for traditional financial inflows.

Uniswap states that Unichain's unique technical architecture improves user experience while ensuring decentralization. This is something that other Ethereum scaling solutions cannot achieve. Mainstream Layer 2 solutions are often criticized for being too centralized, where just the sequencer alone can bring them hundreds of millions or even billions in revenue. Helius Labs CEO Mert also mentioned on Twitter that every major Layer 2 solution can now steal user funds through technology, with Vitalik mentioning that only Arbitrum and Optimism have reached Stage 1 at the time.

Vitalik announced that from next year, he will only discuss Layer 2 solutions that have reached Stage 1, responding to community doubts about selling tokens.

TEE Boosts Rollup-Boost to Resolve the Conflict Between Decentralization and User Experience

In the announcement, Unichain is positioned as a Layer 2 designed specifically for DeFi, a feature that is proven in various technical aspects. For example, speeding up block times to reduce MEV attacks.

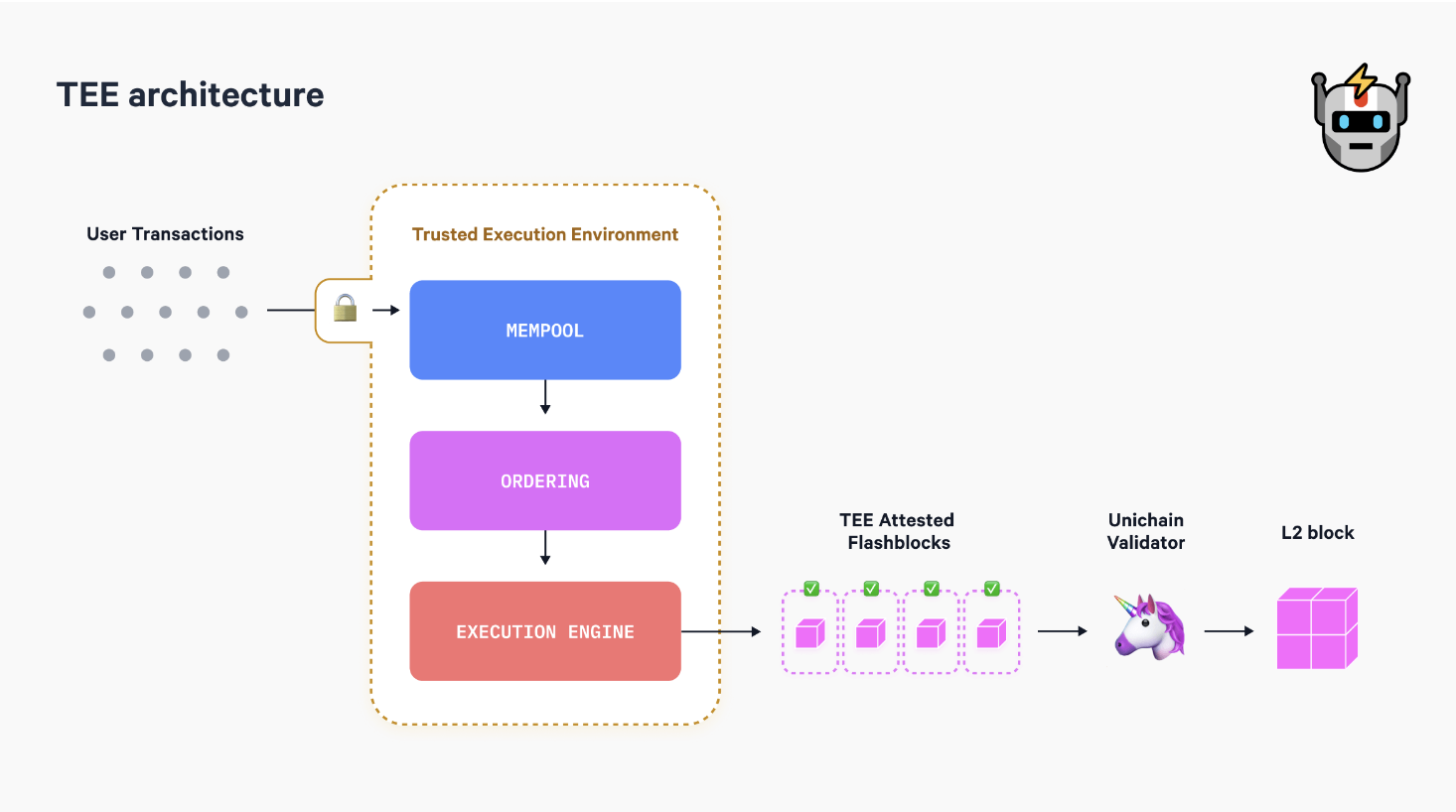

Uniswap Labs and OP Labs have jointly developed Rollup-Boost, a verifiable block generator supported by TEE technology. Trusted Execution Environment (TEE) is a technology that ensures code and data run in a secure isolated environment. In blockchain applications, TEE ensures the privacy of data and computational processes in smart contract execution and improves verification efficiency.

Through Rollup-Boost, Unichain reduces block times to 1 second and will soon introduce Flashblocks with block times of 250 milliseconds. This solves five problems:

- Fast Confirmation Time

Flashblocks can confirm transactions within 250 milliseconds, greatly reducing the time users wait for transaction confirmation. This speed is crucial for user experience, especially in applications that prioritize speed such as decentralized exchanges. Compared to Ethereum's confirmation times of seconds to minutes, Flashblocks provide transaction confirmation speeds comparable to, or even surpassing, Solana. - Native Revert Protection

Flashblocks provide a native transaction revert protection mechanism, meaning users can reduce risks when transactions fail without paying additional gas fees. This helps improve the predictability of blockchain transactions. - Increased Gas Throughput

Flashblocks increase the blockchain network's throughput by increasing the number of transactions each block can accommodate, reducing transaction congestion. It can handle more transactions during high traffic periods, reducing transaction delays and gas fee fluctuations. - Verifiable Priority Ordering

Flashblocks internally provide a verifiable transaction priority ordering mechanism, giving users stronger guarantees that their transactions are ordered based on predetermined priorities and not arbitrarily reordered by miners or validators, a common issue in many blockchains known as "Maximum Extractable Value (MEV)." - Internalizing MEV for Applications

Through verifiable priority sorting, applications can internalize MEV. MEV refers to additional profits block producers can obtain by reordering, inserting, or canceling transactions. Flashblocks' mechanism allows applications to control these sorting logics internally, reducing external intervention, better protecting users, and increasing transaction transparency and fairness.

Unichain separates the roles of the block generator and sequencer, using the Verifiable Block Builder developed in collaboration with Flashbots. The block building operation runs on Intel's TDX hardware in an open-source building code library. This hardware provides private data access and verifiable execution through computational integrity features. A breakthrough point in TEE execution is that the proof of execution will be publicly disclosed, allowing users to verify if the block is constructed as required in the TEE.

The MEV Trilemma assumes that blockchain designers can only choose from three types of auction models, including Explicit Auction, which explicitly bids, Spam Auction, which creates a large amount of traffic to congest the network, and Latency Auction, which is more decentralized but less advantageous for retail users. High-performance public chains like Solana typically default to Latency Auction, but computational nodes tend to be relatively centralized.

Rollup-Boost uses TEE's remote verification and horizontal scaling technology to reduce geographical node centralization issues. Essentially, TEE enables provable, cost-effective off-chain execution similar but not identical to traditional Layer 2 solutions on-chain logic. While Rollup-Boost currently uses centralized RPC and sequencers, the application of TEE will gradually transition to a more decentralized infrastructure, ensuring transactions are not exposed to third parties throughout the execution process. While TEE cannot replace decentralized consensus, it offers stronger trust and security compared to other block generators.

Joining the Superchain Universe: Can the OP Family Become Ethereum's Answer?

Optimism's Superchain project has been mentioned multiple times. In short, any development using the OP Stack can be considered part of the Superchain. The Superchain is essentially the same as chain abstraction narrative, where users using the Superchain will not realize they are using a specific chain. Specific chain abstractions include shared liquidity and shared gas fees. For example, users do not need to consider whether they are currently using Base ETH or OP ETH when participating in smart contracts on the Superchain; gas fees are universal, eliminating cross-chain hassles. Chain abstraction is not only user-friendly but also integrates liquidity from hundreds of fragmented public chains.

According to the previous Optimism Superchain airdrop eligibility announcement, OP Mainnet, Base, Zora, Mode, Metal, Fraxtal, Cyber, Mint, Swan, Redstone, Lisk, Derive, BOB, Xterio, Polynomial, Race, and Orderly all belong to the Superchain ecosystem. The upcoming Soneium developed by Sony and Unichain will also join this big family.

It's like the Warriors team with Stephen Curry and Klay Thompson adding KD; they form a strong alliance. For Unichain, this is a wise move. As the DeFi chain that focuses most on liquidity, just integrating the liquidity of OP Mainnet and Base on the Superchain is enough to surpass most Layer 2 solutions on the market.

The technical documentation also mentions account abstraction, which, although difficult to define, can be understood as lowering the barriers to blockchain usage. For example, users do not need to remember mnemonics; they can log in with Web 2 accounts like Facebook/Twitter to have their own blockchain addresses. While some may argue that tying it to Web 2 social media violates the decentralized ideal, it is undeniable that transitioning technology into widespread adoption with users unknowingly using the technology is a necessary process, as seen with Meta pushing AR technology for widespread adoption.

Meta announces the removal of the Spark creator tool platform! Custom IG filters will be unavailable starting next year.

The Key to UNI Token's 20% Price Surge: Unichain's PoS Mechanism Empowers UNI Token

Next, let's discuss the key factor driving the nearly 20% surge in the UNI token price. Unichain's validation nodes operate by establishing a decentralized Unichain Validation Network (UVN) composed of multiple node operators responsible for independently verifying the latest state of the blockchain. This design aims to reduce risks in a single sequencer architecture and speed up block finality, especially for settling cross-chain transactions.

Node operators must stake Unichain's native token UNI on the Ethereum mainnet to become validators. The staked UNI token amounts are recorded by Unichain's smart contracts, which receive notifications for staking or unstaking operations via the native cross-chain bridge.

Unichain's blocks are divided into epochs of a certain length. At the beginning of each epoch, a snapshot of the current staked amount is taken, and rewards for each staked token are calculated. Participants add their staking weight to specific validators to increase the validator's staking weight. Validators with the highest staking weight are selected for the Active Set, which qualifies them to verify blocks and receive corresponding rewards.

Launching the Mainnet in November: Will Unichain Spark a Layer 2 Technology Revolution?

More importantly, Unichain is a modular Layer 2. This means that these technical frameworks are open-source and available for various Layer 2 applications. Unichain is the first application launched after Rollup-Boost, but through open-source technology, more Layer 2 solutions can utilize TEE technology to improve blockchain efficiency and user experience while ensuring decentralization and solving MEV issues.

The testnet is already live, and the official mainnet launch is scheduled for November. Starting from early 2025, the features outlined in the technical documentation, such as verifiable block construction and the Unichain Validation Network, will be progressively validated.

Data Reveals Unichain Could Crush Ethereum?

However, there is a warning based on data showing that in the past thirty days, the ETH destroyed by Uniswap alone accounted for 13% of the entire Ethereum network. After the passage of EIP-4844, transaction fees on Layer 2 have significantly decreased. How low are they exactly? Uniswap states that moving transactions to Layer 2 execution can save 95% of fees, indicating that Ethereum's token burning volume may undergo significant changes.

Currently, Ethereum tokens maintain an annual increase of 0.7%. Unichain is set to launch its mainnet in November, and perhaps a month later, we will gradually verify whether the migration of Uniswap transactions will have a significant impact on Ethereum's tokens.

Another concern is highlighted in a previous report by CoinShares, which mentioned that Ethereum's usage has become predominantly speculative. For example, 90% of transaction fees on Ethereum go to decentralized exchanges, with Uniswap alone accounting for 15% of the entire network. This is also why the author believes that Uniswap's move is a significant one that affects Ethereum as a whole.

Another issue is the excessive information in Ethereum's infrastructure transaction fees, with MEV accounting for half. This is closely related to the issues Unichain aims to address.

CoinShares Report: Concerns about Ethereum's Long-Term Value, Revealing Key Drivers of Ether

Uniswap's decision to build its own Layer 2 also echoes the concerns of developer Max Resnick. As he mentioned, Ethereum's mainnet and Layer 2 solutions no longer seem to have a mutually beneficial relationship. Layer 2 might even be the "Ethereum killer."

He believes that Ethereum's mainnet and Layer 2 need to differentiate in transaction categories to end their tense competitive relationship. Layer 1 should focus on improving mainnet efficiency to match Layer 2 standards, while the more Ethereum features inherited by Layer 2, such as decentralized sequencers, the closer it gets to Ethereum.

Ethereum developers discuss development dilemmas, revealing that Ethereum has lost its way.

Celebrity Comments on Uniswap's Move: Unnecessary and Security Under Scrutiny

SlowMist founder EvilCos commented on Twitter: "A protocol that has been operating stably on Ethereum, tested for security, including centralized security, smart contract security, and blockchain infrastructure security. This protocol needs to focus on ensuring centralized security, smart contract security, etc., which is already challenging... At this point, it now wants to build its own L2... So it has to solve many blockchain security issues... The security complexity has increased from 10 to 100... Why bother yourself? Why bother users..."

Related

- L2 Scalability Solution Eclipse Implements Solana Virtual Machine for the First Time, Integrates with Celestia to Optimize Data Storage

- Synthetix founder launches new platform Infinex, aiming to surpass Binance with a new DeFi experience

- Bitcoin-wrapped token cbBTC project to integrate with Solana, Coinbase: Users are loving Solana