Explainer: Understanding DeFi from Scratch - Practical Article + Recommended Tools

The emergence of blockchain technology has not only led to the rise of new assets such as cryptocurrencies but has also brought revolutionary breakthroughs to traditional finance, supply chain, cross-border remittances, data privacy, intellectual property, and other application areas. Among them, "Decentralized Finance (DeFi)" is currently one of the most prominent and widely adopted applications.

Table of Contents

What is DeFi?

DeFi stands for Decentralized Finance, which broadly refers to financial applications such as trading, lending, insurance, options, prediction markets, payments, and other related financial services based on blockchain technology and digital assets.

How Does DeFi Differ from Traditional Financial Services?

Most applications in the current mainstream market, such as Robinhood, eToro, Lending Club, Credit Karma, online banking, mobile payments, etc., are based on centralized service providers. This means that the services provided by these applications rely on intermediaries on the platform responsible for auditing, credit rating, settlement, and asset custody. While these platforms have provided comprehensive services for financial services over the past few years, they also bring innovations and conveniences.

However, despite the sophistication of their business models, these centralized service providers still face inherent issues, such as high operational costs, inefficient settlement processes, service interruptions due to network failures, and geographical restrictions on financial services. Service providers also have significant power to restrict or deny users' access. These inherent issues have given rise to the development of "Decentralized Finance (DeFi)" based on blockchain.

Compared to traditional finance, DeFi applications based on blockchain offer characteristics such as instant settlement, resistance to censorship, and lack of geographical restrictions, allowing people to freely access financial services as long as they have internet-connected devices, thus realizing the vision of inclusive finance.

How DeFi Operates

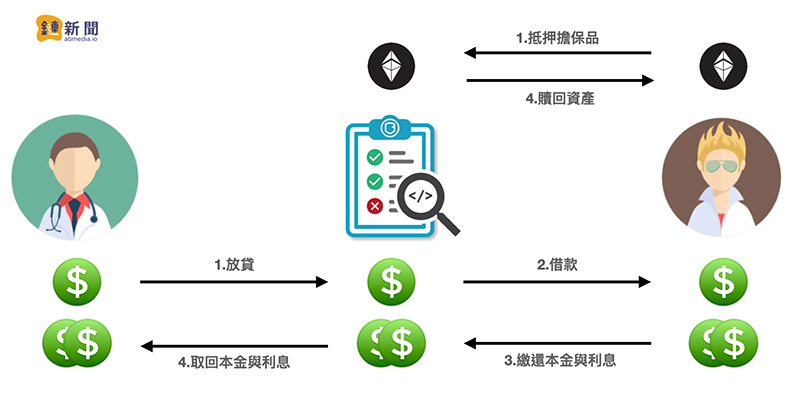

When using DeFi applications, we are actually interacting with the blockchain's smart contracts through the platform's interface. Taking decentralized lending platforms as an example, most of them use over-collateralization mechanisms, where the value of collateral must be higher than the borrowed amount. Both the collateral and the loaned funds must be stored in decentralized "smart contracts" smart contract, not controlled by a single individual or organization (varies depending on the contract code).

If the ratio of collateral value to the borrowed principal falls below a certain threshold (i.e., the collateral value is "about to but not yet" insufficient to support the borrowed principal and interest), the contract will automatically liquidate the collateral, repay the borrower's debt, and protect the lender's interests. Although there is a possibility of lenders losing their principal if the collateral's value drops too rapidly, even during events like the Black Swan events on March 12, 2020, or May 19, 2021 (market-wide single-day drops of over 30%), most decentralized lending platforms can still pass stress tests smoothly.

Lenders do not need to know who the borrowers are or their creditworthiness throughout the process, as all rules are governed by smart contracts, eliminating the need for significant trust costs for both parties.

Why is DeFi Popular?

The popularity of DeFi can be traced back to the rise of "Yield Farming" that gained momentum last year. Yield Farming, a term that is difficult to understand literally, usually translated into Chinese as "liquidity mining," means:

"Users can earn the platform's issued tokens as rewards by interacting with or providing liquidity to DeFi platforms (such as trading on the platform, collateralizing assets, lending, borrowing, etc.)."

The concept is similar to the "trading mining" introduced by the Fcoin exchange in 2018, where users receive "governance tokens" as an airdrop by using the platform's services. Liquidity mining allows DeFi platforms to distribute a portion or even all tokens to actual users, enabling users to participate in the platform's governance decisions. Simultaneously, for users, selling airdropped tokens can generate additional income and significantly increase overall returns from participating in DeFi, attracting more users and funds into the DeFi space.

Additionally, participants in the cryptocurrency market are mostly profit-driven. Therefore, implementing liquidity mining on DeFi platforms can attract a large amount of funds and liquidity in a short period, quickly gaining market attention. This serves as a beneficial marketing strategy for the project's early development.

Independent DeFi Ecosystems

While users interact with these DeFi applications online, each DeFi operates on different blockchains that run independently and cannot directly interoperate. For example, assets on Ethereum cannot be deposited into DeFi applications based on another blockchain network like Solana, and assets on Solana cannot be deposited into DeFi applications on Ethereum. Currently, for DeFi applications to interoperate, they must be based on the same blockchain, leading to different blockchains forming their own DeFi ecosystems.

The DeFi ecosystems with high total locked assets and a large number of users currently include: Ethereum, Binance Smart Chain (BSC), Solana, Polygon, Fantom, and more. When users participate in various DeFi ecosystems, they must first create a wallet on the respective blockchain and transfer assets cross-chain to interact with the applications in each DeFi ecosystem.

Various DeFi Protocols

Each DeFi ecosystem is a complete financial system, encompassing many different types of applications. Here, we briefly introduce several common applications in the DeFi field, using typical applications in the Ethereum ecosystem as examples:

Decentralized Lending (e.g., Compound, Aave)

The lending market is one of the crucial early applications in the DeFi space, where users can earn passive income by depositing idle funds on these lending platforms, while also being able to deposit collateral and borrow crypto assets for financing and leverage trading.

Automated Market Maker Protocols (e.g., Uniswap, SushiSwap)

Automated Market Maker (AMM) protocols are the primary decentralized exchange platforms in various DeFi ecosystems, with no order book concept. Therefore, for users, it operates more like a "currency exchange" than a "traditional exchange." One unique aspect of automated market maker protocols is that anyone can become a liquidity provider by providing funds and earn fee rewards paid by third parties during transactions.

Aggregator Protocols (1inch)

In a DeFi ecosystem, there are usually multiple decentralized exchanges (DEXs). In the Ethereum ecosystem alone, there are over 20 trading platforms, meaning that asset liquidity is dispersed across various platforms. The function of aggregator platforms is to help users capture the best prices across multiple platforms and execute transactions in a single trade, minimizing users' slippage issues.

Synthetic Asset Protocols (Synthetix, Mirror Protocol)

Beyond trading crypto assets, many development teams and projects aim to introduce real-world assets into the DeFi space. Synthetic assets are solutions developed to achieve this goal, similar in concept to derivative contracts on centralized exchanges. They use digital assets as collateral to generate tokens that track the prices of stocks, bonds, forex, and other assets. In addition to real-world assets, synthetic assets can also be used to create decentralized stablecoins, inverse tokens (shorting), leveraged tokens, and other derivatives.

Leveraged Mining Protocols (Alpha Homora, Alpaca Finance)

Many AMMs have liquidity mining programs where users can provide liquidity as liquidity providers to earn fee and mining rewards. To maximize fund utilization efficiency, some protocols emphasize this opportunity and introduce leverage functions. Platforms like Alpha Finance allow users to increase their provided liquidity to 2x or even 6x by paying interest. At the same time, the fee rewards and mining rewards earned by users will also increase proportionally.

Stablecoin Swap Protocols (Curve Finance)

Stablecoin swap protocols, similar to AMMs, allow users to exchange assets. The difference lies in the optimized pricing model of stablecoin swap protocols, resulting in lower slippage during transactions compared to traditional AMMs, especially when exchanging stablecoins with pegged tokens like WBTC, renBTC, sBTC, etc.

Decentralized Money Market Platforms (yearn finance)

The concept of decentralized money market platforms is similar to funds in traditional finance. Users deposit assets into smart contracts and are managed by the protocol's decentralized governance organization, enabling functions like automatic compounding and automated rebalancing to save users time and fees in managing assets.

Decentralized Insurance Protocols (Nexus Mutual)

The most significant risk in DeFi is the potential loss of assets due to smart contract vulnerabilities and hacker attacks. Decentralized insurance protocols provide protection for users in this aspect, offering users DeFi policies through concepts resembling "betting" or "mutual aid," providing insurance for users' DeFi assets.

Cross-chain Asset Protocols (Anyswap)

With the development of blockchain technology, various blockchains are gaining attention. In this trend, infrastructures that allow assets to interoperate across different blockchains become increasingly essential. Cross-chain asset protocols provide users with cross-chain bridges, allowing users to "lock" assets on one side and "release corresponding assets" on the other side, achieving asset cross-chain functionality in a decentralized manner.

DeFi Risks

Although DeFi applications are developed on decentralized blockchains, this does not guarantee absolute safety. In the end, DeFi, despite being decentralized protocols, is still susceptible to risks as long as there is code involved. If developers leave backdoors or the protocol's design is not sufficiently decentralized during the deployment of DeFi contracts, or if there are bugs in the contract code or logic, it could lead to users' assets being drained. Therefore, when choosing DeFi, one should not blindly assess based on interest rates but should comprehensively evaluate factors related to security, such as TVL, protocol longevity, open-source code, burning of administrator keys, adoption of multi-signature, time locks on contracts, etc.

Resources

Ethereum Ecosystem

1 Ethereum DeFi Overview:

2 Ethereum DeFi Deep Data:

https://app.intotheblock.com/insights/defi/charts

3 Liquidity Mining and Lending Rate Overview:

https://www.coingecko.com/zh-tw/yield-farming

https://coinmarketcap.com/yield-farming/

4 All-in-One Asset Management Platforms:

https://yieldfarmingtools.com/

BSC Ecosystem

1 BSC DeFi Overview:

2 Liquidity Mining and Lending Rate Overview:

Related