Swaziland proposes CBDC plan that allows for physical card storage and supports offline payments

The Central Bank of Eswatini recently issued a report on the Central Bank Digital Currency (CBDC) Digital Lilangeni here. This digital currency will be pegged to the South African Rand (ZAR) in order to promote local payment convenience, financial inclusion, and enhance cross-border payment efficiency with neighboring countries.

Digital Lilangeni will be pegged to the South African Rand (ZAR) as part of Eswatini's monetary policy due to Eswatini's participation in the Common Monetary Area (CMA) in Southern Africa, which includes countries such as South Africa, Eswatini, Lesotho, and Namibia.

Given that South Africa is the largest and most stable economy in the region, these countries have agreed to peg their currencies to the Rand and allow member state currencies to circulate within the area. Therefore, the Eswatini Lilangeni and ZAR have a fixed exchange rate.

By maintaining a stable exchange rate between the Digital Lilangeni and the Rand, Eswatini can increase trust in the Digital Lilangeni, making it more reliable for regional payments and cross-border transactions, providing more security for the overall economy.

Table of Contents

Designing CBDC for Swaziland's Needs

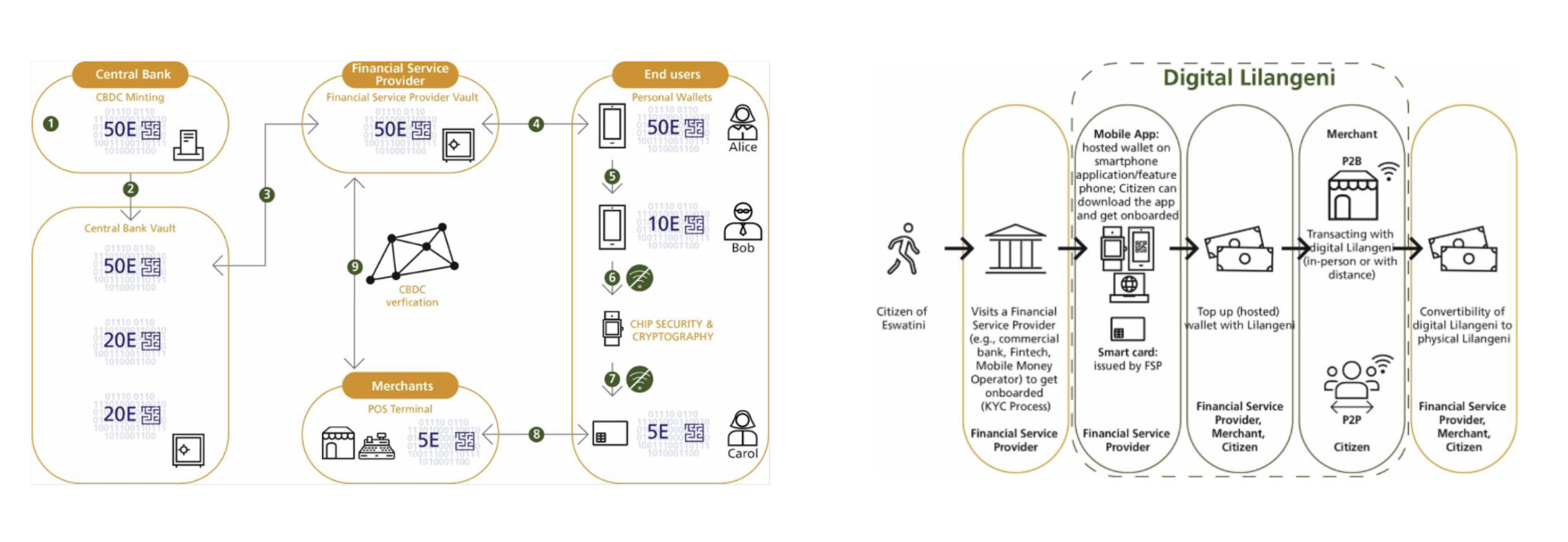

The solution indicates that Digital Lilangeni will be executed in the form of a Central Bank Digital Currency (CBDC) on a decentralized database. Digital Lilangeni can be used for peer-to-peer (P2P) payments and merchant payments, and is planned to support small payments and programmable payment functions. It can be divided into two types of wallets for use: an online wallet managed by financial institutions and a hardware wallet called a smart card that supports offline payments.

Overview of the Digital Lilangeni Design:

- Two-tier Structure: Digital Lilangeni is intermediated by financial institutions for issuance and circulation, while the Central Bank of Swaziland provides the infrastructure.

Registration and Issuance: During the registration process, financial institutions are responsible for issuing offline devices to users, such as smart cards. These cards can be used for online payments, including scenarios such as merchant POS machines and mobile contactless payments, making it convenient for local users to transact with Digital Lilangeni in their daily lives.

Recharge and Conversion: Before using Digital Lilangeni, it needs to be recharged with physical Lilangeni or bank deposits. Bank accounts can be linked to Digital Lilangeni wallets, allowing users to easily switch between physical and digital funds.

Convertibility: It provides the option to convert Digital Lilangeni into physical cash at any time, maintaining flexibility.

- Offline Payment Capability

CBDC Design Balancing Privacy and Functionality, Testing Underway

Digital Lilangeni adopts "pseudo-anonymity" to protect user privacy, meeting KYC and anti-money laundering requirements while safeguarding privacy. In addition, Digital Lilangeni has programmable functions that allow users to automatically set payment purposes or configure settings for specific users, such as imposing spending limits on children.

The report states that the Central Bank of Swaziland is currently collaborating with technology company Giesecke+Devrient and utilizing the Filia CBDC technology to develop Digital Lilangeni. Digital Lilangeni has completed conceptual verification, sandbox testing, and real-world scenario testing.

Note: German company Giesecke+Devrient primarily provides secure technology solutions for digital payments and CBDC.

Challenges Encountered in the Implementation of Digital Lilangeni

- Time Management: Estimating the time required for technical integrations in the two-tier structure of CBDC is challenging.

- Early Engagement of Stakeholders: Stakeholders such as the Central Bank of Swaziland and financial institutions must engage in early technical discussions to establish consensus.

- Lack of Expertise: There is a shortage of technical professionals familiar with CBDC, necessitating extensive training.

Future Challenges for Digital Lilangeni

Although the Central Bank of Swaziland is promoting a "reduce cash usage" policy, advocating for methods like mobile payments and card payments, cash remains the primary mode of payment for locals. For Digital Lilangeni to be widely accepted locally, it needs to overcome reliance on cash and encourage more people to transition to digital payments. Digital Lilangeni must also be compatible with existing electronic payment systems to integrate into daily payment scenarios; otherwise, its application scope will be limited.

Chainalysis: Inflation pressures are accelerating the adoption of cryptocurrencies in the Central and Southern Africa region.

Related

- Swaziland proposes CBDC plan that allows for physical card storage and supports offline payments

- Swiss National Bank's CBDC pilot project enters its third phase: expanding participation of financial institutions and extending for another two years

- San Francisco Fed Hiring CBDC Architect, Florida Governor and Republican Lawmaker: CBDC Must Be Banned