Coinbase suspected of involvement in large-scale insider trading, may list multiple low-quality cryptocurrencies

In order to promote information parity and enhance transparency, Coinbase announced on the 12th of last month the list of cryptocurrencies that may be added to its platform by the end of the second quarter. However, a few hours after the announcement, prominent cryptocurrency trader Cobie posted an Ethereum address, raising suspicions of potential insider trading involving large sums.

Table of Contents

Insider Trading at Coinbase?

Found an ETH address that bought hundreds of thousands of dollars of tokens exclusively featured in the Coinbase Asset Listing post about 24 hours before it was published, rofl pic.twitter.com/5QlVTjl0Jp

— Cobie (@cobie) April 12, 2022

According to Twitter content, Cobie mentioned that a Ethereum wallet address purchased hundreds of thousands of dollars worth of cryptocurrency the day before Coinbase announced the potential listing of certain coins, all of which were on the list.

The post included the following coins: NDX, KROM, RADAR, RAC, DFX, and PAPER. Since Coinbase's article was published, the prices of these coins have rapidly increased by approximately 20% to 60%. This has led to speculation that internal employees may have profited significantly by trading on advance knowledge.

Coinbase has not yet responded to this matter, and the truth remains to be verified.

Cobie Criticizes Coinbase Listing Standards

Historically, Cobie has frequently expressed dissatisfaction with Coinbase's listing standards on Twitter. After the announcement of the potential listing of new coins, Cobie further analyzed several of them, highlighting how unreasonable it is to list these coins.

1. Big Data Protocol BDP

This protocol launched a 6-day high APY dual pool farm last year, with Tron founder Justin Sun and quantitative trading firm Alameda Research investing millions in mining. However, due to a smart contract error, the protocol inadvertently locked people's assets, leading to a significant drop in users.

Prior to the listing announcement, BDP's token price was stagnant, but after the news, it surged over 132%, doubling its market value in a short period.

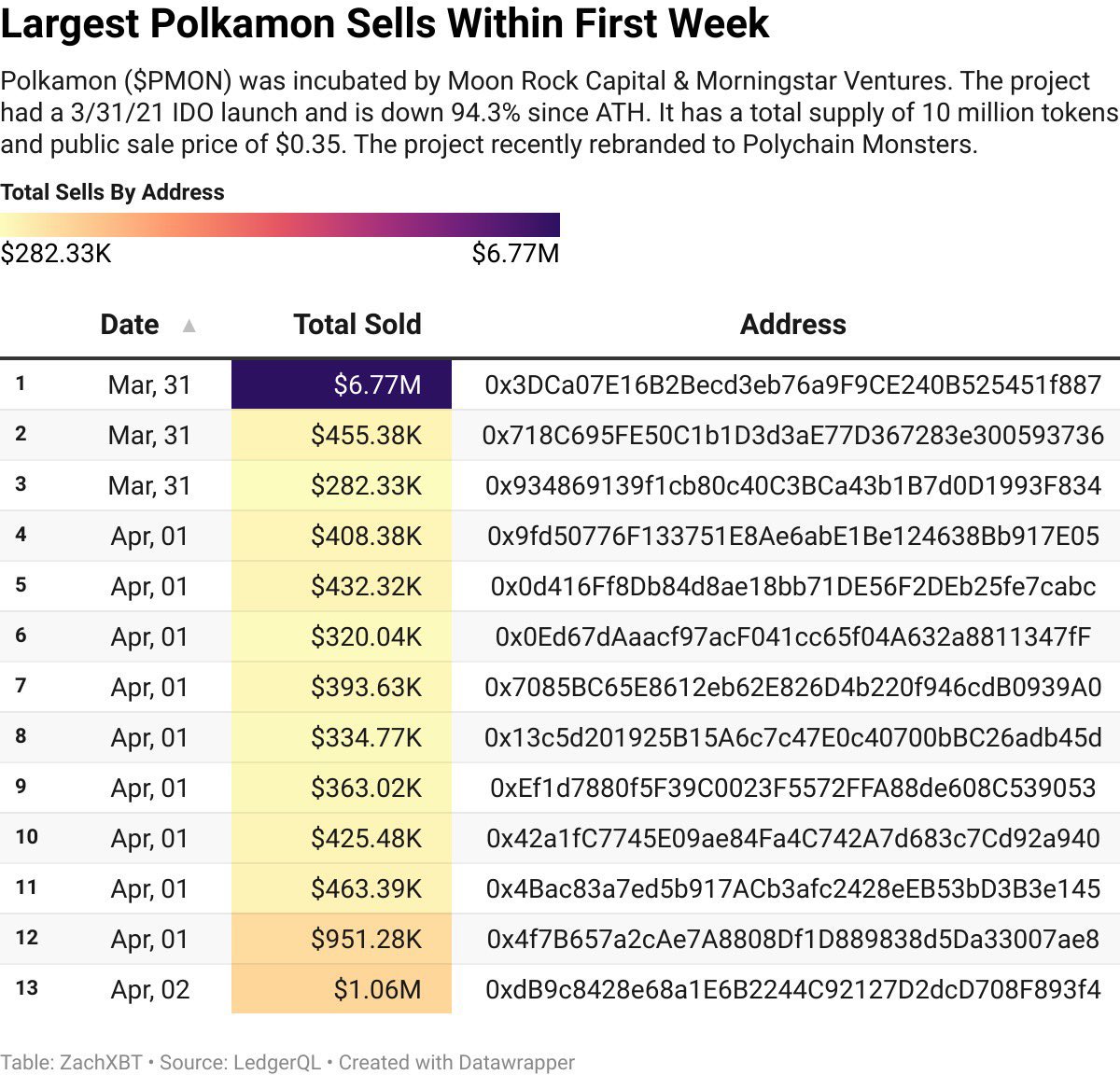

2. Polkamon PMON

This protocol conducted an Initial DEX Offering (IDO) at the end of March last year. However, within days after the IDO, early supporters started dumping their holdings, causing the token price to plummet by over 95%. Since then, it has struggled to attract interest, yet now it may have the opportunity to be listed on Coinbase.

3. Student Coin STC

Cobie believes the name of this coin has a strong resemblance to the ICO era in 2017. The token experienced an over 80% drop in 2021 with no signs of recovery, and there has been no announcement regarding any adjustments to token supply. The true reasons for listing this coin may only be known to Coinbase's listing team.

"I'm glad to see Coinbase continues to stay at the forefront of decentralization by listing coins that have been dead for a year and garbage coins, continuing to adopt trustless technology," Cobie stated.

Related

- a16z founder amazed: AI robot Truth Terminal can raise funds autonomously and propose business plans to generate profits on its own

- Elon Musk supports Trump in speech, harshly criticizes obstacles to freedom of speech and technological development in the United States

- VanEck prices Solana at $330, calls on institutions to hold SOL