Diamond Hands No Longer Profitable? Venture Capital: Prices of Recently Issued Tokens Will Inevitably Drop

Regan Bozman, co-founder of the cryptocurrency venture Lattice, has summarized an interesting conclusion regarding token issuance trends this year: the prices of recently issued tokens are bound to fall. Due to overvaluation and the prevalence of airdrops, there will be a lack of buyers to sustain token prices, leading to a continued downward trend in the long term.

This article is compiled and translated. For any doubts, please refer to the original source.

This article does not constitute investment advice.

Table of Contents

Background: Token Market Cap

Before discussing token economics, make sure you understand the two specific terms for assessing token market cap:

- Market Cap = Circulating Token Supply * Price, excluding locked tokens

- Fully Diluted Valuation, FDV = Price * Total Unlocked Token Supply

Market cap represents the total value of market demand, which fluctuates with price trends. Assuming good liquidity, market cap can be a reliable indicator.

It's important to note that market cap only represents circulating tokens. An increase in market cap does not necessarily indicate additional demand for other locked tokens, as holders of locked tokens may also be willing to sell at a discount. Therefore, market cap has little relevance to the value of locked tokens.

From this perspective, including locked tokens in the calculation of FDV may be an extremely inaccurate indicator of true value.

However, FDV is crucial for venture capitalists since these institutions hold locked tokens. Most tokens received by venture capitalists typically have a one-year lock-up period, followed by linear unlocking over another 18 to 36 months.

Venture capitalists often value assets based on the expected FDV in the next three to four years to provide investors with a figure, but the market does not necessarily operate this way.

Inevitable Decline in Recent Token Issuance Models

Alright, so what's the new phenomenon in token economics we're talking about?

Bozman believes that the current token issuance structure is fostering a "down-only" issuance model. Tokens are issued with a higher FDV, gradually dissipating as users who received airdrops sell off, and then collapsing in price due to extensive VC unlocking.

Why? Let's first look at the recent token issuance landscape.

Recent Changes in Token Economics

Recent token issuances exhibit four main characteristics:

- Issuance of tokens with high FDV

- Circulating token supply < 20%

- No public token sales

- Large airdrops

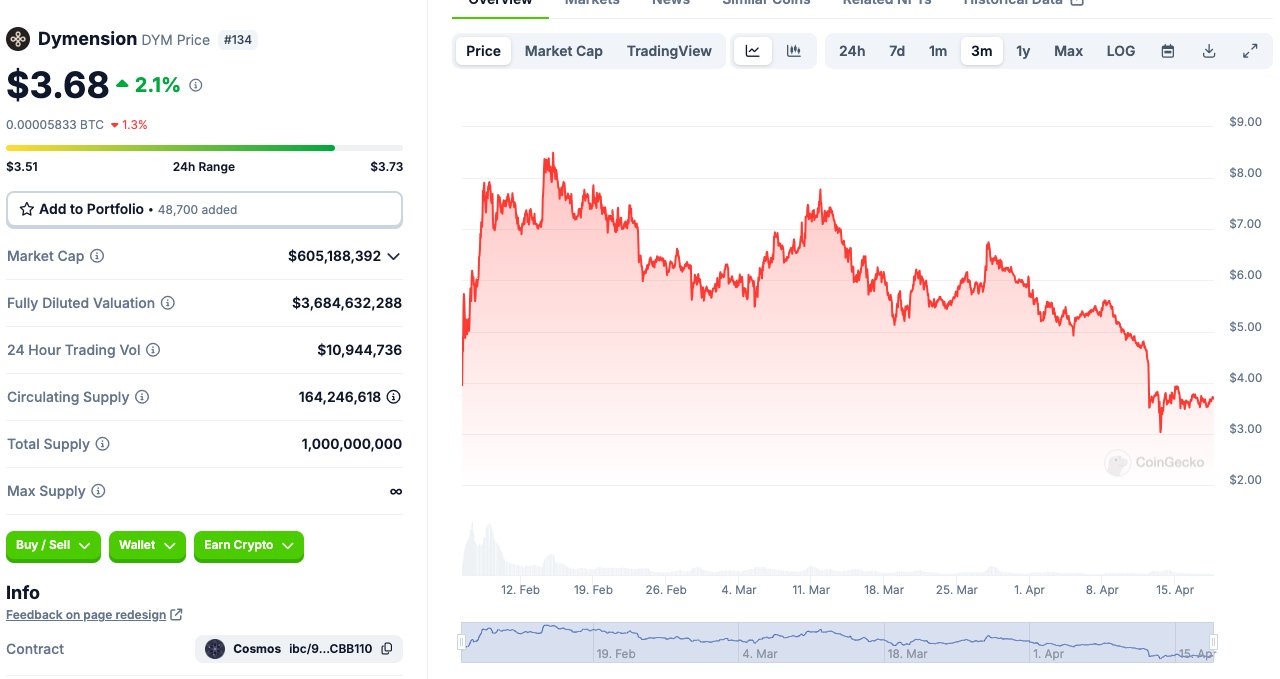

For example, Dymension has an FDV of 8 billion, with an initial circulating token ratio of only 16%, no public token sales, but airdrops worth hundreds of millions of dollars.

Another example is Starknet, with an initial FDV of over a hundred billion dollars, an initial circulating supply of around 10%, no public token sales, but airdrops worth 20 billion dollars.

Comparatively, past token issuances did not exhibit such phenomena. Most dominant public chain projects today typically did not meet the above four points during their initial token issuances:

- FDV below $10 billion

- Similar unlocking patterns, but usually shorter unlocking periods

- Retail investors could purchase at relatively lower prices (FDV less than $5 billion)

- No airdrop plans

For instance, when NEAR issued tokens, although only 20% of tokens were in circulation at the time of issuance, community sales immediately started unlocking, with 50% of tokens circulating in the market within a year; SOL initially had only about 20% of tokens circulating, but about 75% of tokens circulated in the market after a year. Initial FDVs ranged from $3 to $5 billion; in the first 18 months of trading, LINK's FDV typically remained below $10 billion.

So, what problems might the recent token issuance model create?

Thoughts on Token Buyers and Sellers

Token prices only rise when there are more buyers than sellers. So, who are the buyers in today's market? Certainly not institutional investors! Yes, there are some hedge funds and crypto risk investment funds buying tokens, but there isn't much capital flowing into the liquidity market.

Excluding BTC and ETH, their annual inflow of funds is only $10 to $15 billion.

Just this week, we've seen the issuance of three tokens with a total supply exceeding $5 billion, with no chance for enough institutions to absorb the supply in the market. Ultimately, all these tokens will end up being bought by retail investors.

However, retail investors have limited interest in high-valued, low-circulating tokens. This is because:

- These tokens are expensive, and no one would find it worthwhile to buy something with a FDV already in the double digits.

- Through these large airdrops, retail investors can get tokens for free! So, why buy more?

Are the Most Anticipated Token Issuances of the Year Really Worth the Hype?

EigenLayer might issue tokens with an FDV exceeding a hundred billion dollars. Knowledgeable ETH holders have long been staking in anticipation of token issuance, with over 3% of ETH already deposited into EigenLayer, forming an ecosystem worth over $50 billion around the narrative of airdrops.

Recommended Read: How will the re-staking project EigenLayer change the Web3 infrastructure?

Reason for recommendation: This article comprehensively explains EigenLayer's design philosophy, problem-solving aspects, current development status, allowing readers to quickly understand why its design is attracting significant funding.

Logically speaking, users who want EigenLayer's airdrop likely already hold ETH and may be using that ETH to earn Eigen tokens or points. A significant portion of potential buyers may receive tokens for free without purchasing.

Of course, investors can buy more, but how many will? For institutions, if EigenLayer eventually reaches a $200 billion FDV, institutions would lose interest; the same goes for retail investors. Bozman doesn't believe there will be a surge of retail investors willing to buy EIGEN tokens at a $250 billion FDV.

So, the target audience for EigenLayer's token issuance is limited, but what about the sellers?

If EigenLayer's FDV is high enough, token-holding investors will likely want to sell. From a $100 million seed round to a $200 billion FDV, profit-taking makes perfect sense.

Will airdrop participants sell? While there is no data yet on this round of airdrops, people value things they get for free less than things they purchase. Additionally, airdrop participants typically receive a proportion relative to the value of ETH they deposited, limiting the significance of holding. Therefore, airdrop participants are also expected to sell tokens.

Bozman states that everyone is well-intentioned, and EigenLayer is indeed an innovative product, but it can be reasonably inferred that the current token issuance model often leads to long-term price declines.

How to Mitigate the Inevitable Decline in Token Effects?

Bozman believes that the following three methods have the potential to mitigate the inevitable price decline in recent token economics:

- Linear unlocking of tokens

- Public token sales

- Genuinely innovative projects

Linear Unlocking of Tokens

Bozman believes the correct direction for token issuance is to have 20 to 25% of tokens in circulation at the time of issuance, with locked tokens unlocking linearly over 36 months.

Public Token Sales

Furthermore, projects should opt for public token sales to allow large-scale purchases by retail investors. The demand for Near's token sale was so high that it caused the CoinList website to crash twice. Many projects already have significant demand before token issuance!

Allowing the community to accumulate tokens with real money in addition to airdrops will increase user loyalty.

Genuinely Innovative Projects

Projects with innovative applications and use cases typically garner higher market expectations. Projects that performed well this week often have novel designs or innovations, such as Ethena or Jito.

Solana's largest third-party client, Jito, will issue governance token JTO

The market may have grown tired of being pushed the tenth data availability DA modular solution.

Recent Token Issuances May Not Be Worth Holding Long-Term

In conclusion, before changing the token issuance practices systematically in the industry, Bozman indicates that the current data is already sounding the alarm. The current token issuance structure is unlikely to lead holders to long-term success. It's advised not to listen to bad advice from VCs, advisors, or anyone else; diamond hands may not succeed this year.

Price increases can help foster a genuine community and developer ecosystem, but the opposite is true, and it can be harsh.

Recommended Read: What should be considered when issuing tokens? How to avoid legal risks that may be pursued by the SEC?

Reason for recommendation: This article explores token issuance methods from a legal regulatory perspective, allowing for a comprehensive evaluation of token risks in the future, in conjunction with the economic perspective presented in this article.

This article is not investment advice.

Related

- Trump mocks He Jinli with McDonald's fries; McDonald's food poisoning causes stock price to plummet by 6%

- "Fed Board Member Discusses Blockchain and U.S. Financial Development, Saying 'DeFi Can Improve Financial Efficiency'"

- Why do people always buy pseudo-scientific products like Qi Ease, a "spiritual commodity" developed by former National Taiwan University President Lee Si-chen, which falls into the category of technology and pseudoscience?