ERC20 Token Analysis Shows: Most High-Yield Tokens Are Concentrated

Two-thirds of 2019 has already passed, and aside from a small surge in the middle of the year, the cryptocurrency market has been relatively quiet, with the anticipated bull market not materializing.

Table of Contents

Since the beginning of the year, Bitcoin has risen by about 170%, Ethereum by about 64%, XRP has dropped by 16%, Bitcoin Cash has risen by 113%, and EOS has risen by about 51%. Most of the other small-cap altcoins have performed poorly, but there are also some standout projects.

LongHash has analyzed ERC20 tokens issued on the Ethereum network in an attempt to discover small-cap tokens with outstanding performance this year. In this study, we selected the top 1000 ERC20 tokens by market capitalization, excluding tokens with a market capitalization exceeding $1 billion and stablecoins, totaling about 900 tokens. We analyzed these tokens from multiple dimensions, including price, year-to-date annualized return, trading volume, number of token holding addresses, market capitalization, and the concentration of token distribution. The concentration of token distribution calculates the proportion of the total holdings of the top 20 addresses holding the token to the total token supply, excluding exchange addresses and token issuance or burning addresses.

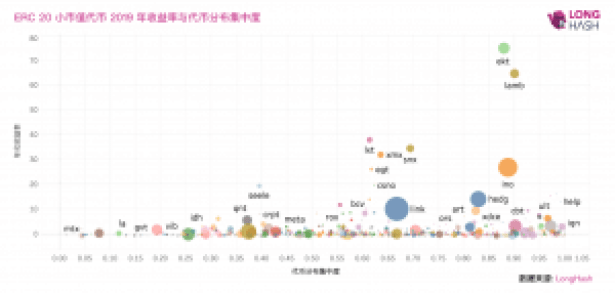

Among the tokens we analyzed, there are 12 tokens with a market capitalization exceeding $100 million, 81 tokens with a market capitalization between $10 million and $100 million, and 813 tokens with a market capitalization below $10 million. In terms of returns, over half of the tokens have negative returns, but there are 38 tokens with returns exceeding 500%.

Most of these 38 tokens with remarkable returns have a higher concentration of token distribution. The majority of them have a concentration of over 60%, with some even exceeding 90%. While there is not a direct correlation between token returns and distribution concentration, we generally believe that tokens with smaller market capitalization and higher distribution concentration are more susceptible to price manipulation by whales. However, we also found that individual tokens with larger market capitalization have also seen remarkable price increases. For example, LINK with a market capitalization of around $600 million has an annualized return of nearly 10 times; another token, INO, with a market capitalization of $370 million, has an annualized return of over 26 times, and its token distribution concentration is as high as 88%.

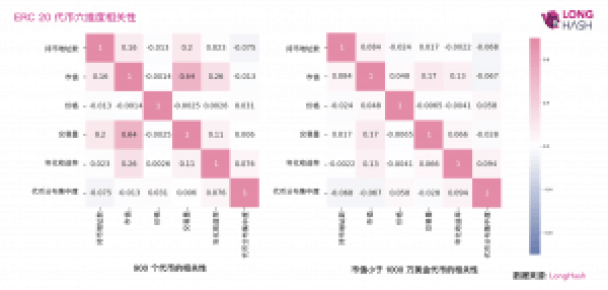

We conducted a correlation analysis of the attributes of price, annualized return, trading volume, number of token holding addresses, market capitalization, and concentration of token distribution across these dimensions.

As shown in the above figure, the left side represents the correlation of all 900 tokens, while the right side represents the correlation of tokens with a market capitalization below $10 million. From the left chart, it can be observed that there is a certain correlation between returns and market capitalization and trading volume, with the concentration of token distribution ranking third, having a correlation of 0.076 with returns. However, when considering only tokens with a market capitalization below $10 million, the correlation of the remaining attributes with returns decreases, with only the concentration of token distribution showing an increase in correlation. This indicates that small-cap tokens are more likely to achieve high returns when the token chips are more concentrated.

Originally published on LongHash

Related Readings

- Is the blockchain trend in Taiwan's development "outdated"? Ge Rujun: The execution speed is fast, but the strength is not fully utilized

- [Newcomer Coin View] A brief discussion on smart contracts, where is the "smart" and where is the "contract"?

Join now to get the most comprehensive information on financial technology, blockchain innovations, and industry examples!

Related

- Binance Launches Unique "Pre-Market" Spot Trading Service: Be the First to Hold New Tokens

- Former Coinbase Executives Launch New Exchange TrueX, Featuring PayPal-Backed Stablecoin PYUSD Trading Pairs

- Financial Times reveals Telegram's financial report: the encryption giant disguised as a communication platform relies on TON support to cover operational losses