NEO strives to replace Ethereum as the most developer-friendly blockchain.

NEO is actively investing resources to compete with Ethereum and become the most "developer-friendly" blockchain. With the support of several senior Microsoft personnel, the project is strengthening its platform's core capabilities, with a total funding exceeding 5 billion US dollars.

Table of Contents

NEO History

NEO is a smart contract platform founded in China with the aim to provide the "best infrastructure needed for mass adoption," as stated by founder Da Hongfei at the 2019 NEO Community Summit.

The project was initially launched in June 2015 as "Antshares" and rebranded as NEO in June 2017, focusing on asset digitization and building the "next-generation internet."

The rebranding coincided with the 2017 bull market frenzy, earning NEO the title of "China's Ethereum Killer." Overnight, the project went from obscurity to being in the top 10 by market capitalization.

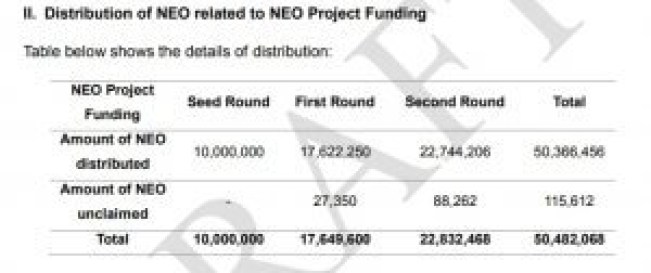

Since early 2019, NEO has been actively leveraging its resources to expand globally. NEO boasts over $535 million in assets on its balance sheet, with a majority coming from the 50 million tokens out of the total supply of 100 million NEO tokens reserved during its fundraising activities.

NEO is utilizing these resources to build a more robust blockchain platform. In February of this year, it opened a development center in Seattle, bringing in several former Microsoft managers including John deVadoss to lead the project.

Developer-Friendly Platform

John deVadoss, the current Global Head of Development in Seattle, has over 16 years of experience at Microsoft, serving as the principal software architecture developer for Windows and .NET.

There are an estimated 150,000 blockchain developers globally. However, deVadoss believes:

Blockchain is currently limited to elite developers, as only elites can easily learn esoteric programming languages and non-traditional tech stacks.

DeVadoss points out that one of Ethereum's biggest mistakes was creating Solidity. The new language is not developer-friendly and has become a major barrier to mass adoption in the developer community.

Reports indicate that NEO is learning from Ethereum's mistakes. NEO aims to support a variety of widely available programming languages such as JavaScript, Java, Python, and Go. DeVadoss stated:

To get adoption, you need developers first, and then users come. NEO is targeting the current 7 million developers using .NET and Visual Studio Code per month. By leveraging familiar development tools, these engineers can be converted to NEO developers in the future.

NEO is not just talking; it is investing heavily.

In May 2019, NEO announced EcoBoost, a $100 million initiative for blockchain-related software projects. For comparison, the Ethereum Foundation planned expenses of $30 million this year.

Overtaking Ethereum

Founder Da Hongfei explicitly stated that they are attempting to surpass Ethereum. He stated at this year's Seattle Summit:

Our mission is to make NEO the number one public chain in 2020. We only have one or two years, and time is ticking.

However, Ethereum has established a leading edge so far, making all other smart contract public chains pale in comparison, especially in terms of developer adoption.

While NEO executives believe Ethereum's decentralization leads to slow decision-making, Ethereum still has significant momentum, with its open-source ecosystem continuously growing.

In terms of market capitalization, the total market value of all smart contract public chains is about $30 billion, with Ethereum accounting for 63% with a valuation of $18.9 billion. NEO only holds 2.1% of that market, with a market value of $641 million.

In terms of developer activity, Ethereum also dominates. 18% of all active crypto developers work in the Ethereum ecosystem, totaling over 1,200 developers. In contrast, according to Electric Capital analysis, NEO has fewer than 100 developers.

To replace Ethereum, one needs a flexible foundation and unique value proposition. NEO may succeed, but becoming an "Ethereum Killer" is far from certain.

Related Readings

- Bitcoin still has 31 mining reward halvings to go

- Chinese cryptocurrency holders are mostly young and optimistic about Bitcoin's prospects

Join now to get the most comprehensive fintech information, blockchain insights, and industry examples!

Related

- Solana's strongest competitor has emerged with good news! Sui's official cross-chain bridge goes live

- Game company MagicBlock develops ephemeral rollup to enhance gaming experience on Solana

- Instagram is changing! The layout is being revamped to be more like TikTok, causing influencers to potentially rearrange their content.