HBAR Foundation tokenizes BlackRock Fund causing misunderstanding, token HBAR experiences extreme price volatility

The public blockchain Hedera's developer HBAR Foundation recently claimed to have successfully tokenized the BlackRock money market fund. The cryptocurrency community seemed to believe that HBAR had a deep collaboration with BlackRock, but BlackRock later denied the news, leading to a sharp rise and fall in the HBAR token.

Table of Contents

BlackRock Fund Goes On-chain? Public Chain Hedera Announces Collaboration Causing Misunderstanding

According to the announcement from the developer of Hedera, the HBAR Foundation, recently, the UK compliant exchange Archax and the HBAR Foundation jointly launched a tokenized product for BlackRock's money market fund MMF.

Both the BlackRock MMF and existing products can be used on the Archax platform after tokenization. The first tokenized stock transaction of BlackRock MMF was successfully completed on the digital asset network of tokenization service provider Ownera FinP2P.

Today we witness #RWA history as @BlackRock’s ICS US Treasury money market fund (MMF) is tokenized on @Hedera with @ArchaxEx and @OwneraIO, marking a major milestone in asset management by bringing the world’s largest asset manager on-chain 🏦 pic.twitter.com/1Kye8cjAJx

— HBAR Foundation (@HBAR_foundation) April 23, 2024

Hedera HBAR Experiences Sharp Rise and Fall

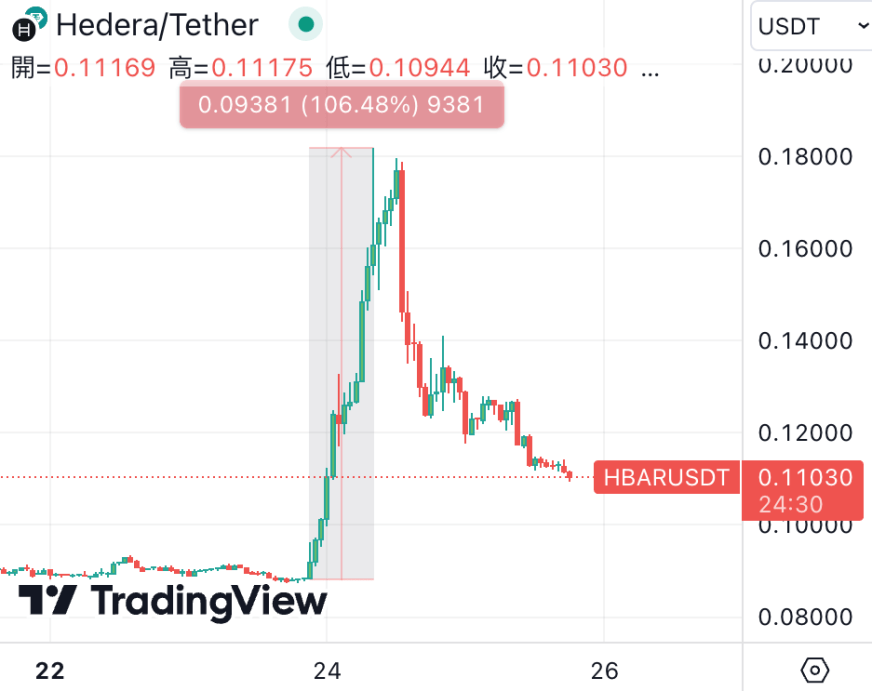

As indicated by the tweets and announcement, the crypto community seemed to believe that there was deep cooperation between HBAR and BlackRock. The HBAR token surged by 106% within 12 hours of the news release, rising from $0.088 to $0.181.

However, some later claimed that BlackRock had never participated in the fund tokenization, causing HBAR to subsequently drop by 40%.

The tweet from the HBAR Foundation also received a large number of comments and community notes correcting the information.

BlackRock Spokesperson: No Commercial Relationship

A spokesperson for BlackRock told Cointelegraph:

BlackRock has no commercial relationship with Hedera, and BlackRock has not chosen Hedera to tokenize any BlackRock funds.

Graham Rodford, CEO of the exchange Archax, explained the situation in a lengthy tweet, stating that it was users' desire to invest in BlackRock's money market fund that led to the tokenization, and emphasized that BlackRock was aware of their actions.

The HBAR Foundation currently keeps the tweet pinned and has not provided an explanation for the community's misunderstanding, only retweeting an interview conducted by Archax's CEO after the incident.

(17/18) If we decide to tokenise, arguably we do not need to approach the investment manager, but we always do as we want long term relationships. The investment manager’s level of involvement can vary but both abrdn and Blackrock were aware that we were tokenising on Hedera.

— Graham (@Grodfather) April 24, 2024

Related

- Taiwan's lack of Starlink truth? Musk's secret connection with Putin exposed: Starlink, Taiwan, and U.S. elections influence

- BIS Fintech Project Aperta: Enables end-to-end encrypted data to enhance global financial data interoperability

- Reviewing the collapse of TonUP, the high-profile Launchpad plummeted 99%. Does this symbolize the demise of TON?