Renzo's token issuance controversy continues, indirectly leading to the detachment of ezETH.

The recent announcement of token issuance by the re-collateralization project Renzo has caused quite a stir, from angering the community with token economics and airdrop rules, to the significant issue of the ezETH liquidity token becoming unpegged. As a result, the team today announced a new set of distribution rules. However, these events have prompted the market to reevaluate the team's professionalism.

Table of Contents

Renzo Controversy Continues

REZ Tokenomics Criticized for Unfairness

According to the original airdrop rules set by the Renzo team, users who staked ETH were only eligible for 5% of the token allocation, with half of it locked for six months, and almost 70% of the token allocation went to internal parties such as the team and investors. This immediately drew criticism from the community, as they believed the benefits did not align proportionately with the risks undertaken.

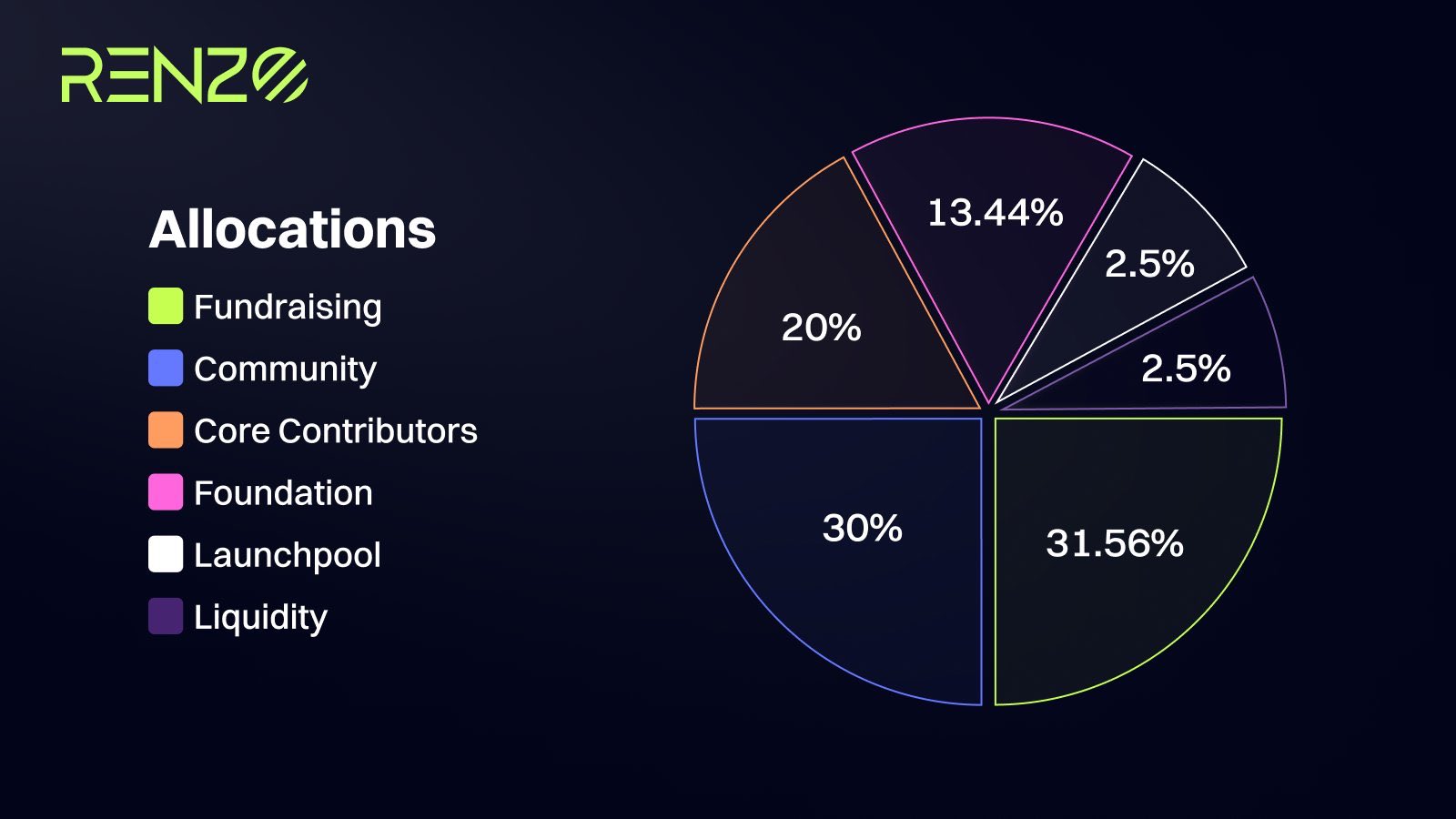

On the other hand, community members accused the team of intentional misrepresentation. From the introduction diagram of the team's initial tokenomics, it can be seen that Renzo allocated the same amount, 2.5%, to both the Binance Launchpool and Liquidity as to the Core Contributors, which totaled almost 20%, while the combined Community and Fundraising allocation below was 61.56%, but the pie chart seemed to show only half of that.

ezETH Decoupling

The evaluation criteria for the above REZ token airdrop rules are based solely on ezPoints and do not change based on holding ezETH, meaning that selling ezETH now or waiting until 4/30 to sell yields similar benefits.

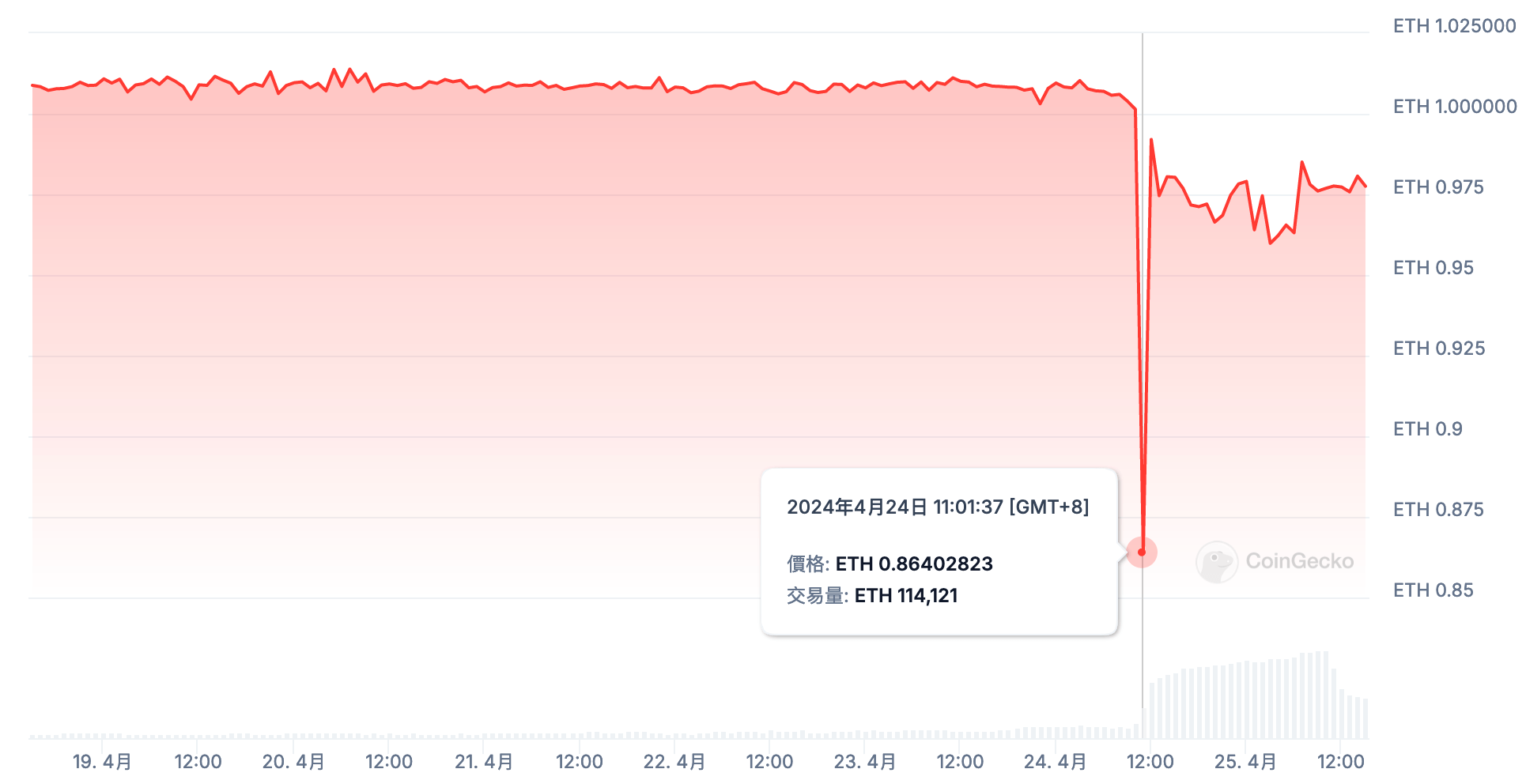

Perhaps due to this, ezETH experienced a significant decoupling at this time. According to CoinGecko data, ezETH dropped to around 0.86 ETH at its lowest and has yet to recover.

Updated REZ Tokenomics

Due to ongoing market controversies, the Renzo team released a new version of the tokenomics and airdrop rules today, starting a two-phase airdrop campaign.

REZ Token Basic Information

- Name: REZ

- Mainnet: Ethereum ERC-20

- Address: 0x3B50805453023a91a8bf641e279401a0b23FA6F9

- Total Supply: 10 billion tokens

- Initial Circulating Supply: 1.15 billion tokens

Token Distribution

- Fundraising, Investors 31.56% remains the same as original: Early investors receive a large portion with a two-year lockup, 10% released after the first year, with the remainder linearly unlocked.

- Community 32% +2%: 7% of the total token supply is airdropped to users holding ezPoints for Season 1 activities; 5% allocated for the next Season 2 activities; remaining tokens not planned.

- Core Contributors 20% remains the same as original: Two-year lockup, linear distribution starting after one year.

- Foundation 12.44% -1%: Allocated for the foundation's discretion.

- Binance LaunchPool 2.5% remains the same as original, no lockup, refer to this article for more details.

- Liquidity: 1.5% -1%: For centralized and decentralized exchanges, no lockup.

The overall airdrop ratio has increased from 10% to 12%, with a threshold of 360 ezPoints, the team claims that 99% of wallets qualify. However, whether the market will accept this change remains to be seen in the long-term development.

Renzo's Professionalism Under Evaluation

Changes made in the short term to the tokenomics that require careful consideration have been quickly adjusted under community disputes, unprofessional token pie chart announcements, or ezETH decoupling; all these actions are being closely watched by users, gradually diminishing Renzo's project professionalism and brand value.

It is only able to proceed due to the bullish market and institutional support at present. If such incidents were to occur during a bearish market, the market may not give the team a second chance.